What is Eigen Layer. Evolution in DeFi. Full analysis of the project

EigenLayer recently opened up its pools to test liquidity provisioning and re-staking, and something completely uncharacteristic of a bear market occurred. In a short time, 100 Ethers of liquidity were poured into the pools, and many simply did not have time to deposit their money, because… A total limit was set for all pools.

What interested experienced cryptans so much and why did they sit with approved contracts and wait for the pools to open? Why is there so much liquidity in such a market and so much hype around EigenLayer? What is hidden under the hood of the project, what are its prospects, and how to prepare so as not to miss the opportunity to make money on it? All this is in today’s material. Go!

Content

1. What is EigenLayer. Why is the project needed and what problem does it solve?

4. Technical part. How does EigenLayer work? Protocol functions

5. What problem does EigenLayer solve?

6. How can I test EigenLayer and make money on it?

7. Conclusions. Development prospects for EigenLayer

1. What is EigenLayer. Why is the project needed and what problem does it solve?

EigenLayer is a protocol that allows ETH staking participants to voluntarily use their ETH on a consensus layer. What does it mean?

Now users who stake ETH on their own network or using LST (about liquid staking we wrote here) will be able to connect to EigenLayer to reuse their assets and generate additional profit.

But still, why did EigenLayer receive such a share of hype in such a weak market? The answer to this question lies in understanding how Ethereum works. If you are not good at this, then turn to our articles, starting here, then here, here. Well, if you’re a complete nerd, then dive into our Telegram channel.

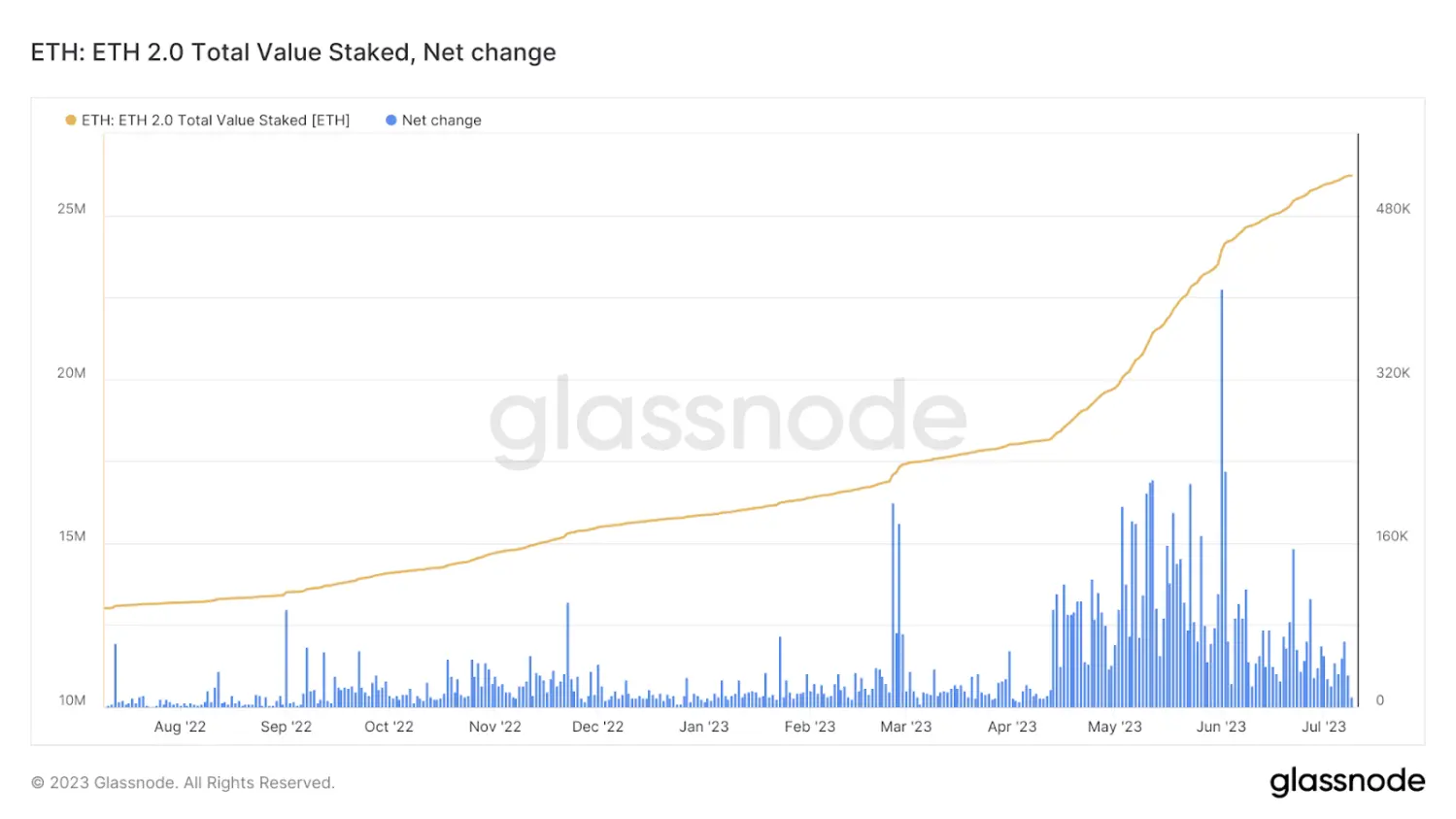

In short, in April 2023, Ethereum developers activated the Shapella update, which included several changes to the consensus and execution levels. The most important of them is the possibility of withdrawing ETH from the deposit account. contract Beacon Chain.

The hard fork caused a surge of interest in cryptocurrency staking. Over three months, the volume of assets blocked in favor of the validation mechanism increased by 130%, exceeding 26 million ETH.

The influx of liquidity is largely due to the fact that validators were able to unlock assets. In the eyes of potential investors, the finalization of the Proof-of-Stake (PoS) mechanism has turned staking into an understandable and relatively risk-free model of passive income.

The Shapella hard fork also created the necessary conditions for the emergence of new directions and the implementation of projects, the launch of which was previously impossible due to restrictions in force on the network. And one of these areas is re-staking. It is on restaking that the protocol is based, which we will thoroughly analyze today.

2. What is restaking?

The concept of re-staking has a lot in common with merge mining. By the latter, I mean the process of simultaneously mining two or more cryptocurrencies without reducing the overall mining productivity.

The model essentially allows the same proof of work to be accepted as security guarantees across multiple networks that have compatible Proof-of-Work (PoW) consensus algorithms.

When applied to PoS blockchains, the concept involves re-staking capital that is already staked for similar purposes.

Restaking is possible thanks to the infrastructure that EigenLayer offers. Let’s understand the technical part. Let’s start with EigenDA.

3. EigenDA architecture. What is it, why is it needed, and how does it ensure the functioning of the ecosystem?

EigenDA is a secure, high-performance and decentralized data availability (DA) service built on top of Ethereum using an optional EigenLayer.

EigenDA will be the first AVS (actively validated services) in the EigenLayer ecosystem. Once launched, restakers will be able to delegate stake to node operators performing verification tasks for EigenDA in exchange for paying for services and merging blocks. The user, in turn, will be able to publish data to EigenDA to gain access to lower transaction costs, higher transaction throughput, and secure composability within the EigenLayer ecosystem. However, security and throughput are designed to scale horizontally depending on the number of re-stakes and operators who decide to serve the protocol.

Why is EigenDA needed?

In general security systems, including EigenLayer, each node operator must download and store every chain that uses the system. Few node operators will be able to cope with this task, and the system risks eventually becoming centralized. EigenDA is designed to prevent this tendency towards centralization; it provides high performance by distributing work among many participating nodes, requiring each operator to perform only a small amount of work.

Globally, EigenDA aims to demonstrate that Ethereum stakers and validators can support critical Ethereum infrastructure in addition to Ethereum consensus, and that AVS (e.g. EigenDA) and AVS users (e.g. federations using EigenDA) can succeed with new business models and tokens on top of the Ethereum trust network.

EigenDA architecture

The diagram below shows the main data flow through EigenDA.

So, initially Rollup Sequencer creates a block with transactions and sends a request to divide the data block (Disperser).

Disperser is responsible for encoding data blocks into fragments, generating KZG-liabilities And KZG-proof with multiple disclosures, as well as for sending commitments, fragments and evidence to the operator nodes of the EigenDA network.

For convenience and to amortize the cost of signature verification, participants can use their own dispenser or use a dispenser service provided by a third party (e.g., EigenLabs). It is possible to use the dispatch service optimistically, so that in the event of unresponsiveness or censorship, the service can use its own dispatcher as a backup, thus gaining the benefits of optimistic mode amortization without sacrificing censorship resistance.

EigenDA nodes validate the received data streams against the KZG commitment using multi-vector proofs, store the data, then generate and return a signature to the disperser for aggregation.

4. Technical part. How does EigenLayer work? Protocol functions

Restakers (participants engaged in re-staking) will delegate their pledged ETH to operators or run validation services themselves (thereby becoming an operator).

In this case, both parties must agree: restakers retain control over their bet and choose for which AVS they agree to perform the validation.

Their difference is that operators perform validation tasks for AVS (ensuring the security and integrity of the network), and AVS offer innovative use cases for assets while leveraging the overall security benefits of Ethereum.

Validators can choose whether to participate in each module built on EigenLayer or not. This creates the conditions for free market management to launch new capabilities as new blockchain modules emerge that may have better trade-offs for security and performance.

The difference between EigenLayer and merge mining

As we said at the beginning of the article, restaking is similar to merged mining. Many of you are familiar with this concept, where miners use the same cryptographic PoW to mine blocks across all chains simultaneously (Dogecoin and Litecoin do this, for example).

However, merged mining does not “convey cryptoeconomic security” (adds security): there is no slashing penalty, and the fact is that even if the smaller chain loses value, the merged-mined chain also loses some benefit.

On the other hand, with restacking, if an incorrect condition occurs, then “the stake held by malicious validators on the main chain will be slashed.”

Thus, in networks with restakes, the cost of damage by subsets will be equal to the amount of restakes from the main chain (that is, smaller groups or segments of validators that act maliciously or make mistakes).

This means that if malicious validators attempt to corrupt the network, they risk losing all of their staked tokens, making such actions very expensive and therefore unlikely.

5. What problem does EigenLayer solve?

Modules that cannot be deployed at the top layer of the EVM cannot rely on Ethereum pooled security (e.g. sidechains with new consensus, DA layers).

Thus, they rely on AVS, which “have their own distributed validation semantics for verification.”

In turn, this is expensive, requires creating a new network of trust from scratch, and entails additional fees and trust requirements.

By participating in EigenLayer, participants can test new modules built on top of Ethereum: consensus protocols, data availability layers, virtual machines, custodian networks, oracle networks, bridges, threshold cryptography schemes, trusted execution environments, etc.

Trustless Security: There is no need to create your own network of trust for distributed validation, but can rely on the security and decentralization of Ethereum.

Thus, EigenLayer can be defined as an open market where AVS can rent the shared security provided by Ethereum validators.

In the example below, we highlight the difference in attack costs on AVS today compared to AVS on EigenLayer (right).

The full text of the project’s technical documentation can be found via this link.

6. How can you use EigenLayer and make money from it?

EigenLayer pools are currently closed. After launching on the main network, the project team gradually expands the pools. In the first phase, LST was raised equivalent to 9,600 ETH, in the second – 45,000 ETH, and most recently in the third expansion, more than 100,000 ETH were raised.

The team will notify you when the pools will open next. on your Twitterso be sure to subscribe and follow the updates.

There are currently three pools in total. You can stake stETH, rETH and cbETH. Subsequently, modifications are also possible, implying the blocking of LP tokens confirming a share in the pool containing ETH or LST.

The action diagram looks like this:

1. You take your ETH and stake it in one of the protocols. If stETH is Lido Finance, if rETH is RocketPool, cbETH can be staked on Coinbase if you have American KYC or taken on DEX where it is listed).

2. Follow the updates and wait for the announcement of the opening of the pools.

3. Enter your synthetic Ether into EigenLayer.

7. Conclusions. Development prospects for EigenLayer

EigenLayer is an infrastructure component that will strengthen the adoption of ETH staking while essentially turning it into a public good that other networks and protocols can use without having to start from scratch with their security.

Considering the trend towards decentralization, security and increasing the capacity of exploitable capital, EigenLayer has great prospects. By using it, developers are relieved of the burden of building their own network of validators, reducing both the initial and ongoing costs required to run the network successfully.

The advantages of EigenLayer over other projects is the ability to create blockchain systems without the need to configure and maintain your own network of validators. This avoids the need for high rates of token inflation to incentivize security provision or the need to launch a native token at all. This way, developers can focus on specific innovations without having to deploy the entire blockchain technology stack from scratch to innovate just one part of it.

This capital-efficient model removes barriers to entry for new blockchain projects and improves the security of existing protocols, paving the way for more flexible, decentralized innovation on Ethereum.

Thanks for reading! If the article was useful, I would be grateful for your like and comment