What assets allowed investors to protect resources during a pandemic?

The crisis caused by the worldwide coronavirus pandemic, in its scale, was comparable to the largest economic shocks of the current and past centuries. Many companies experienced serious problems, their shares became cheaper, in general, the markets of different countries were actively declining.

However, even in such a difficult economic situation, there were financial instruments that allowed, if not to earn, then at least protect assets and seriously limit losses. We will talk about them in our article today.

Shares of companies that benefit from self-isolation

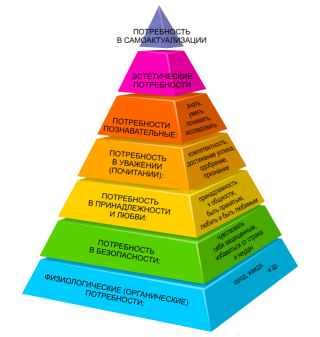

One of the most successful investments of recent months could be the shares of companies whose business is objectively positively affected by mass isolation and the transition to remote work. Among them are streaming services and game developers – people need to have fun at home, as well as equipment and component manufacturers – not all companies equip their home workplace.

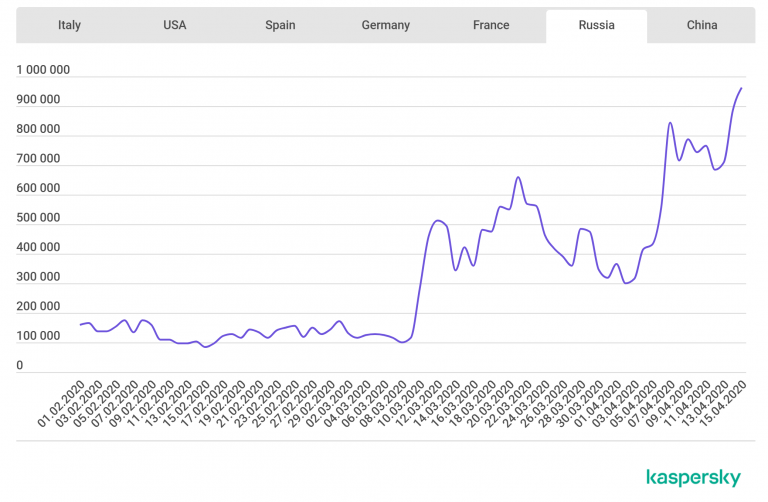

Real explosive growth was shown by services for remote communications. a classic example of this is Zoom, whose shares have risen in price by hundreds of protests despite concerns raised by the lack of information security of the product.

Shares of companies paying dividends

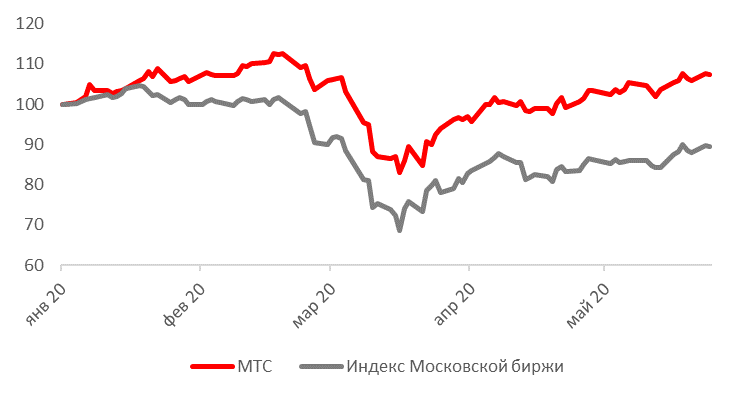

There are such companies in Russia – for example, they feel very well MTS securities. This is logical, because communication and access to content is the last thing the consumer will refuse.

The dynamics of MTS shares turned out to be better than the Mosbirzi index as a whole

Regarding the payment of dividends, the MTS management stated that it does not plan to revise dividend obligations due to the coronavirus. In March last year, the MTS Board of Directors approved a dividend policy for 2019-2021, according to which payments will amount to at least 28 rubles. per ordinary share (56 rubles per ADR) annually.

Protective assets

At the peak of the crisis, ETF index funds, as well as government bonds, became protective tools for investors.

ETF (Exchange-Traded Funds) is a great alternative to investing in stock indices for a limited investor. This financial instrument is traded on the stock exchange in the same way as stocks. In fact, these are foreign exchange investment funds, which are a portfolio of shares or other assets that completely repeat the composition of the target index. For example, ETF with ticker SPY reflects the dynamics of stocks of the S & P500 index. Shares of ETFs themselves are also traded on an exchange.

ETFs cover a large number of different asset classes, so they should be considered as a tool to “average” the portfolio with adequate risk.

Federal loan bonds in combination with individual investment account (IIS).

When using IIS, two types of benefits can be obtained. The first of these is a tax deduction (13%). To receive it, you need to deposit money into the investment account, as well as have an official taxable income (PIT). For example, if you deposit 400 thousand rubles on the IIS, then a maximum of 52 thousand can be returned as a deduction – for this you will need a salary of 33 thousand per month. According to the rules, money must be in the IIS account for three years, it can be withdrawn earlier, but then the deductions will have to be returned.

The second type of benefit when using IIS is exemption from income tax from transactions on the exchange. And this opens up space for low-risk investments – just right for the task of preserving finances.

Bonds are also issued by large Russian companies – and their yield is higher. ITI Capital Analysts Compiled model portfoliowhere such bonds are combined.

Read reviews, market analytics and investment ideas in Telegram channel ITI Capital