Company registration in Georgia

Georgia is a territory located at the junction of the regions of Central Asia and Europe. This country is famous for its favorable investment climate and loyal government programs for financing investors for creating start-ups and conducting business activities. The Startup Georgia Program has been established in Georgia, which operates with 2016 and since then has helped hundreds of business ideas come to fruition. The fund for this program started with $5,000, but its size is gradually increasing; The “Produce in Georgia” program, which is aimed at stimulating development of local production. Through the program, businesses can receive funding ranging from $2,800 to $8,000. USAID Program “Growth in Georgia” with a capital of US$500,000, was established to implement innovative business ideas in Georgian villages near the borders with the self-proclaimed republics of South Ossetia and Abkhazia. This is just part of the list of startup support programs.

According to the rating of the leading publication of the World Bank Group (IBRD-IDA) “Doing business (Business Regulation Assessment)”, Georgia occupies a leading position in the international business arena according to assessment of the ease of business management on the topic “Doing Business”. The most remarkable indicators in the country’s ranking in terms of the level of business friendliness are 99.6%, in the category “protection of the rights of minority investors” – 84%, in the category “best business tax conditions” – 89.2%, in the category “best conditions for international trade” – 90.1%. Doing business by non-residents in Georgia is gaining momentum, as the conceptual geographical location of the country with access to the sea allows it to cover a large area of the international market and easily establish logistics. The stable banking industry and the dynamic development of banking legislation make it possible to carry out transactions without difficulty. It is also important that Georgia joined the Multilateral Agreement on the Automatic Exchange of Country-by-Country Reports, which makes it possible to obtain tax residency under the program starting from April 15, 2023 High-Net-Worth Individual (HNWI) in Georgia without the requirement for continuous stay in the country for 183 days. Facilitated trade conditions with the countries of the European Union and a number of other states (since 1999, Georgia has been a full member of the Council of Europe and the World Trade Organization) also helped Georgia take a leading position in the international market of goods and services. Companies founded on the territory of Georgia are not considered by other countries as companies registered in the jurisdiction of an offshore zone.

The most relevant industries in business in Georgia are:

The industry of individual services, the so-called service business;

The industry for the sale of goods and services (without necessarily being linked to one’s own production);

IT technology industry.

Please note that there are types of activities that are not considered entrepreneurial activity in Georgia. Activities in the architectural, scientific, medical, arts, auditing, lawyering and notary practice, arbitration, mediation activities, activities of tax consultants, and activities of individuals are not considered entrepreneurial activities. The same attitude of Georgian legislation applies to the use by individuals or legal entities or other organizational and legal forms of a micropower power plant connected to the electricity distribution network. Forestry and agricultural activities of individuals. An exception is the case when at least 5 persons who are not family members of the owner of the production work on a permanent basis to carry out the specified activities. In this case, in order to carry out the activity, it is necessary to establish a legal form of entrepreneur. Georgian law defines individuals carrying out the above types of activities as representatives of liberal professions. If desired, representatives of liberal professions can apply the legal forms of entrepreneurs defined by the Law of Georgia “On Entrepreneurs” dated August 2, 2021.

According to Law of Georgia “On Entrepreneurs”a business in Georgia can be registered in the following organizational and legal forms:

Limited Liability Company (LLC);

Joint stock company (JSC, corporation);

Limited company (KO);

Joint Liability Company (SLC);

Individual entrepreneur;

Cooperative.

It would not be amiss to pay attention to the features of each of the above organizational and legal forms of enterprises.

Limited Liability Company (LLC) one of the simplest forms for doing business in Georgia. The founder of an LLC can be either a resident or a non-resident. There are no requirements for the size of the authorized capital. Distribution of the authorized capital in parts between the founders is carried out upon registration. A limited liability company is liable to creditors with all its property, but is not liable for the obligations of the partners of such a company. The manager of an LLC can be either an individual or a legal entity.

Joint stock company (JSC, corporation) – this form of management of activities is practically similar to limited liability companies, except that the capital of a joint-stock company is divided between participants not into parts, but into shares. Such participants are called shareholders. The minimum authorized capital is set at GEL 15,000. The constituent document of a joint stock company must contain information about the maximum amount of capital within which the joint stock company may in the future decide to place shares (authorized capital), as well as the nominal value of the shares (if any).

Limited company (KO) consists of at least several partners who carry out business activities. Participants in such societies can be both legal entities and individuals. CO partners jointly, under a single company name, carry out business activities, the liability of at least 1 partner of which to the creditors of the limited partnership is limited in the amount of the corresponding guarantee amount (limited partner), and the other partner/other partners are liable to the creditors directly and without restrictions as joint and several partners debtors (complementaries). The founding agreement of a limited partnership must contain information about which partner is a limited partner and information about the amount of contribution made by him.

Joint Liability Company (SLC) differs mainly in that in the event of failure to fulfill an obligation as a result of the action or inaction of several management persons, they bear joint liability to the business society. It is also worth noting that a company with joint liability must have at least two partners. All partners have the right to manage the company with joint liability. If the partner of the OCO is a legal entity, then managerial powers are vested in the head/managers of such legal entity. The share of each partner is calculated based on the profit and loss indicators of the business year. The partner's share of the profit is added to the contribution of this partner if it was not made in full.

Individual entrepreneur

This form of business activity is possible only if the individual has a place of registration on the territory of Georgia, which in turn is only possible upon receipt of a temporary or permanent residence permit. It is also worth noting that this form is not a legal entity and is responsible for the obligations of an individual entrepreneur to third parties with his personal property.

Cooperative

This form of entrepreneurial society is established on the basis of the labor activity of members or is created for the purpose of promoting the economic or social activities of members, the task of which is to satisfy their needs and the primary goal is not to make a profit. The cooperative is liable for its obligations to creditors only with its property. To establish a cooperative, there must be at least 5 founders, who can be both individuals and legal entities. The capital of a cooperative can be increased by admitting additional members to the cooperative and making contributions, as well as by members of the cooperative making remaining contributions in full or making additional contributions. The cooperative has a dualistic management system – the manager is elected to a position for no more than three years and is dismissed by the supervisory board.

Data on the organizational and legal form of the enterprise, founders, executive body, business name, identification number and location address are subject to mandatory registration and inclusion in the Register of Entrepreneurs and Non-Entrepreneurial (Non-Commercial) Legal Entities of Georgia.

The founder of a company can be either a legal entity or an individual. The number of company founders can vary from one or more.

To choose the most optimal form of business according to your goals, you need to decide on the type of activity, the number of founders and agreements between them on the procedure and mechanism for the distribution of dividends.

So, the government of Georgia provides the opportunity to register standard companies on the territory of the mainland of this country, as well as registration of companies in Free Industrial Zones. A Free Industrial Zone (FIZ) is a territory defined by borders with a special legal status in relation to the rest of the territory of Georgia, the status of which is expressed for foreign investors in preferential customs and tax conditions for doing business. There are three such zones on the territory of Georgia. These territories of the free industrial zone are enshrined at the legislative level, namely in the Customs Code of Georgia. Their creation was driven by the government’s idea of accelerated economic development of the country, and therefore all tax legislation is friendly to business and aimed at stimulating international investment. Therefore, starting your business in Georgia does not require much effort.

List of territories of free industrial zones of Georgia:

A separate column should highlight another specific area for conducting activities, such as – virtual information technology zone (IT is an abbreviation for Information Technology).

However, it must be taken into account that in the territories of the specified FIZs there are types of economic activities that are prohibited. To such VActivities include:

production and sale of nuclear and radioactive substances;

production and sale of weapons, weapon components and ammunition;

production, sale, storage of narcotic and psychotropic substances;

import, storage, production and sale of tobacco products.

The relevance of conducting various business sectors in accordance with the territories of the free industrial zone of Georgia should be considered. For example, Tbilisi is a favorable environment for activities in the field of providing personal services, consulting and information technology. For the sales of goods and services to international markets, the best place to do business will be Kutaisi. Poti will be a good location for warehousing and distribution of goods, as it has direct access to the Black Sea. Next, we will tell you in more detail about each of the territories of the free industrial zone of Georgia.

Let's start with Tbilisi free zone. This PPE appeared not so long ago, namely in November 2015. Why is this zone attractive for registering a company in Tbilisi TFZ:

location (located in the capital of Georgia);

transport infrastructure (facilitates the logistics of goods, as it has access to the Tbilisi freight transit highway);

access to qualified labor;

ability to connect electricity up to 25 MW;

low tariffs for electricity consumption;

acts as a logistics hub with easy access to the markets of Europe and Asia.

Opening a company in free industrial zone Poti. The Poti Free Industrial Zone is no less attractive than the Tbilisi FIZ (TSIZ), since the processed volumes of economic activity are several times higher than the volumes of the FIZ. The territory of the Poti FIZ is located along the route of the Great Silk Road, which implies access to the markets of East Asia and the Mediterranean. This PPE is a universal platform for conducting all types of commercial activities. There is a favorable environment for the development of trade, production, distribution and logistics industries. The state of Georgia has made sure that investors enjoy all the benefits of loyal tax conditions for organizing business activities. FIZ Poti has land plots with a total area of 300 hectares with dynamic infrastructure. Access to the seaport of Poti, developed highways, and well-equipped international transport access routes create tremendous opportunities for attracting foreign investment. The most distinctive feature of FIZ Poti is the close cooperation of the Georgian government with government agencies as a shareholder. This FIZ will be an excellent solution for companies whose field of activity is related to class I-IV construction, since permission for this type of construction can be obtained from the Poti FIZ Administrator within up to one month from the date of presentation of the project. There are low tariffs for water supply, gas supply and electricity. Due to the developed area of warehousing activities, the cost of cargo handling is one of the lowest among all PPE. For companies whose activities require access to air supply, the Poti FIZ will be a “godsend”. Since the distance to the nearest airport, which is in Batumi, is 90 km, the distance to the international airport is no more than 350 km. On the territory of the FIZ there are two customs checkpoints for rail and road cargo transportation.

Free industrial zone of Kutaisi. The city of Kutaisi is located in the Imereti region and is the second largest city in Georgia. Also, there is a static macroeconomic environment and a liberal trade climate. Light industry, the automotive industry, and warehousing are welcome here. There are many ready-made premises for renting offices and production, which will significantly help and speed up the process of creating your own company in FIZ Kutaisi. FIZ Kutaisi is a business park in which the Chinese company Hualing Group primarily operates. This investor is one of the largest investors in the Georgian economy, with an investment portfolio of more than 600 million US dollars. In 2015, with the assistance of the Georgian government, the “Hualing Kutaisi Free Industrial Zone” (Hualing Kutaisi Free Industrial Zone) appeared. Companies that are registered in the Hualing Kutaisi Free Industrial Zone enjoy such favorable conditions as the absence of restrictions in industries and the volume of goods produced, their import and export. Also, this FIZ has flexible taxes and there is no minimum capital requirement. A tax on the sale of goods to the mainland of Georgia has been established at 4%.

Opening a business account in Georgia

After registering a business in Georgia, you will need to open an account. Georgian companies usually choose the following banking institutions:

Bank of Georgia;

Terabank;

TBC;

Silk Road Bank.

It is possible to open an account in the listed banks if the economic presence (substance) in Georgia is properly organized.

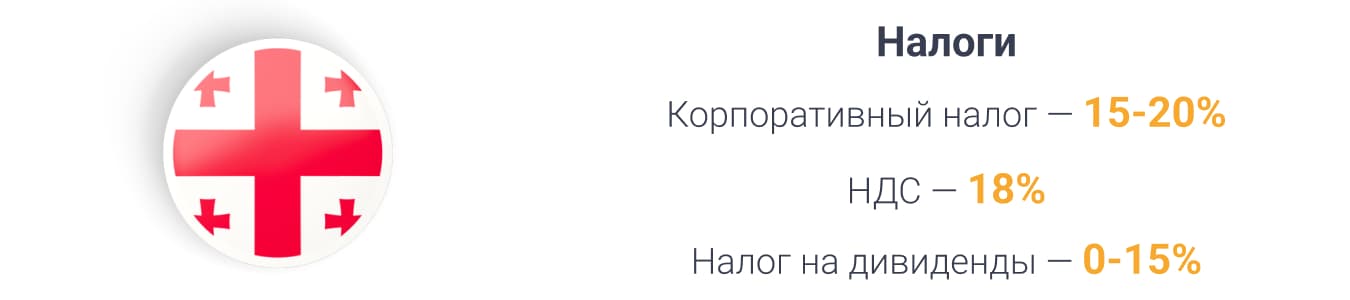

To understand all aspects of doing business in Georgia, you need to briefly familiarize yourself with the current taxes:

income tax is 15-20%;

value added tax is 18%;

Dividend tax is 0-15%.

Firms registered in the territories of Free Industrial Zones in Georgia are subject to different tax regulations. In such zones there is no value added tax, income tax, dividend distribution tax, and there are also no number of government duties and fees on the import and export of goods and services. But, despite the almost utopian conditions for registering and doing business in Georgia, namely in the territories of free industrial zones, there are also a number of disadvantages of registering a company. Possibility of opening corporate account in a bank of Georgia for such a company is possible only if there is an office premises registered with the company, and the presence of employees on staff who are paid monthly wages. But these are not critical disadvantages so that they could become an obstacle to the decision to start investment activities in Georgia. The advantages of opening a company are many times greater than the disadvantages, which can be easily resolved by contacting specialists in the field of business registration in Georgia. Here are several options for solving the above difficulties that you may encounter when opening:

It is possible to open an account in any country outside of Georgia, although it will be much more expensive than in a Georgian bank. It is worth checking with the bank in advance about the need for the personal presence of the director of such a company for identification.

Regarding payment systems, it is possible to use services such as Wise And Paysera.

To summarize, it can be noted that in general, the advantages of registering a company in Georgia in the territories of the free industrial zone are more than the disadvantages, among them are:

no requirement to submit financial statements;

fixed annual license fee, the amount of which depends on the chosen field of activity;

no annual audit requirement;

no value added tax on transactions between companies registered in one of the free industrial zones of Georgia;

no import-export fees and duties on goods and services imported into the territory of the free industrial zone of Georgia;

the possibility of distributing investment income without charging taxes on profits and dividends;

the ability to work through a virtual office;

low cost of electricity.

If you have a need to open (register) a company in Georgia remotely, then you will need to carry out a number of simple preparatory steps. Register a company in Georgia: steps and process.

come up with the name of the future company in Georgian and check it in the Register for matches;

draw up a schematic description of the ownership structure of the future company, indicating identification data for all founders and ultimate beneficial owners;

select the director of the company, take his passport data with the address of the place of registration, telephone number;

choose the types of economic activities that the future company will engage in;

select the address of the office location in Georgia;

company email address;

If we compare company registration in Georgia with other countries, the procedure here is quite easy and not time-consuming.

Typically, the period for registering a company in Georgia is 2-5 working days, after preparing the necessary documentation. Also, when choosing a form of economic activity, you should pay attention to the amount of taxes.

To summarize, you can see with the naked eye that carrying out economic activities on the territory of free industrial zones of Georgia can be a very profitable decision for business. If you are interested in the idea of registering a company in the territory of the FIZ of Georgia, the best solution would be to order personal legal advice on this issue from the experts of a consulting company YВ Case. The company’s specialists will provide legal support during consultation on the topic: how to open a company in Georgia and directly when registering a company in the FIZ of Georgia.