Copyright for NFTs, or a little about the problems of digital assets in the Russian Federation

Although the term NFT is not widely known among people not involved in blockchain technology today, the rapid speed with which it breaks into the daily news agenda is amazing. In order to understand the legal aspects related to NFT, it is necessary to objectify the relevant phenomena and understand its nature.

NFT, or non-fungible tokenis a non-fungible cryptographic token that exists in a single copy (see: Vasilevskaya L.Yu. Token as a new object of civil rights: problems of legal qualification of digital law // Actual problems of Russian law. 2019. N 5. S. 111 – 119).

As can be seen from the term, the key feature of these tokens is their uniqueness, this is what distinguishes them from ordinary fungible tokens (FT), which have the property of interchangeability, when some assets or objects of law can be replaced by others without problems and damage.

The simplest example of such a fungible asset is fiat currencies. So, a banknote of 100 euros can be easily replaced with another original banknote with the same denomination, and nothing will change. Such fungibility is needed for assets that want to become a medium of exchange.

NFT, or non-fungible tokens, in fact, are a certificate of uniqueness of a digital object – a digital cryptographic certificate (digital asset), which confirms the right to own an object of law (including digital), such a kind of “right to right”. For example, you bought a ticket with a QR code for a group concert, which confirms your right to go to it and take your paid seat. This means that no other ticket to this concert can be as unique as yours and cannot be replaced by another ticket.

NFT tokens solve the problem of assigning ownership of virtual objects, provide for exclusive copyright or object ownership rights (see: Efimova L.G. Token as a virtual object of civil law // Banking law. 2020. N 3. S. 42 – 48). Information about the parameters of the item and its owner is recorded in the blockchain. After that, it becomes almost impossible to correct the data (or delete it).

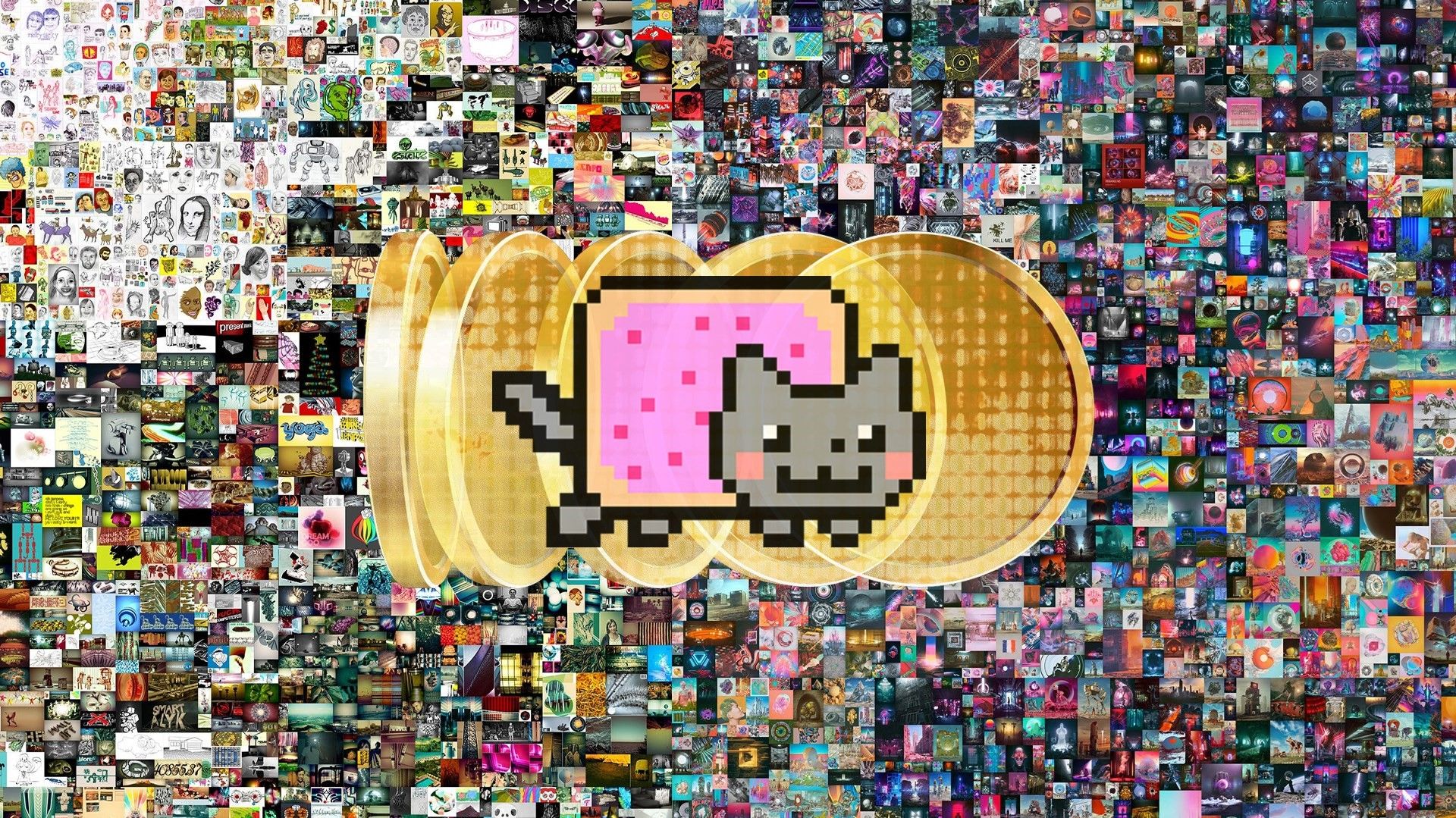

As a result, technology has attracted a lot of attention from people in the art world. For example, Beeple’s NFT-based digital images sold at Christie’s for $69 million, or Sotheby’s auction held in summer 2021, all demonstrate the growing importance of these new digital assets, be it an audio track, art, gif, baseball card, etc. .d.

Additional interest in NFTs is due to the possibility of using them with so-called smart contracts in a particular blockchain environment. A smart contract is, in fact, an automated algorithm designed to generate, control and provide information (functions and data) located at a specific address in the blockchain. To date, there are various standards for such contracts, here are the most popular of them created on the Ethereum platform:

Non-interchangeable smart contract (ERC-721). A simple standard, according to the rules of which each type of token requires an individual smart contract.

Partially Interchangeable Smart Contracts (ERC-1155). An advanced standard that allows you to work with several types of tokens through a single smart contract.

Composite smart contracts (ERC-988). The latest standard that allows you to create digital assets that “own” other virtual assets.

Accordingly, your NFT can, taking into account one or another smart contract, either simply provide for the conditions of ownership and change of ownership for a particular object, or, taking into account the prescribed conditions (algorithms), provide, say, the opportunity every time an object (digital asset) or NFTs are sold and resold, automatically send contracted royalties to the author of the object, demonstrating the flexibility and diverse functionality of these assets.

How NFT is regulated in Russia

Since we are talking about distributed registry technologies, or blockchain, the possibilities for realizing one’s interests in this area are available to every Internet user and there cannot be any geographical restrictions. The crypto industry is already firmly rooted, if not in everyday life, then in the minds of most Russians for sure. And unlike local jurisdictions, this technology is increasingly legitimized at the international level, which greatly simplifies the process of registering and protecting your rights around the world.

The question of the legality of operations with NFT tokens in Russia depends on whether NFT is considered a cryptocurrency or a technology for certifying digital law and digital assets.

Unfortunately, effective from January 1, 2021 Federal Law No. 259-FZ of July 31, 2020 “On Digital Financial Assets, Digital Currency and Amendments to Certain Legislative Acts of the Russian Federation” (hereinafter – Federal Law N 259-FZ) did not consolidate the concepts of “blockchain”, “fungible and non-fungible tokens”, “cryptocurrency”, which led to the creation of new controversial legal structures.

So, in the existing definition of digital currency, an indication is given of the existing obligations of the operator of network nodes to the owner of such currencies, which in fact may be completely absent in the distributed ledger system, as, for example, in the case of bitcoin, where even the name of its inventor is not known for certain, and the principle itself the operation of the system, as well as the receipt of new coins (mining) is associated with certain specific algorithms and protocols that exist and function regardless of the desire of any regulator.

Therefore, if NFT is not technically a cryptocurrency, it can be bought, sold and held with the only restriction related to the prohibition of buying / selling digital assets (see: Sannikova L.V. Digital assets: legal analysis: Monograph / L.V. Sannikova, Yu.S. Kharitonov. Moscow: 4 Print, 2020. P. 178) using digital currency (part 7 of article 14 of Federal Law N 259-FZ).

NFT and Copyright Issues

Most often, when talking about NFTs, we will talk about copyright for digital assets, respectively, they should be considered within the framework of part four of the Civil Code of the Russian Federation (hereinafter – the Civil Code of the Russian Federation), which regulates the rights to the results of intellectual activity and means of individualization.

At the same time, no special changes related to copyright protection in the field of digital property have been made to the fourth part of the Civil Code of the Russian Federation after the adoption of Federal Law N 259-FZ, nevertheless, some conclusions are becoming more and more obvious.

First, the purchase of an NFT does not automatically imply ownership of the copyright in the associated digital objects, unless they were specifically acquired as part of a license agreement. In the absence of such a contract, the owner of the NFT has no right to make or sell copies of a work of art, or otherwise exercise copyright in a work of art.

This means, for example, that by acquiring an NFT for an object of art in the material world, the owner of the NFT does not acquire any rights to the object of material art itself and cannot dispose of it.

Even posting an NFT image on social media can be suspicious from a copyright standpoint, as such posts automatically create an unauthorized digital copy. This reality may significantly limit the ability of NFT owners to publish or otherwise publicly display an NFT-related image without liability for copyright infringement.

Second, since anyone can create an NFT, even for an image they don’t actually own, the NFT can significantly influence the nature and frequency of copyright infringement. NFTs allow infringers to commodify art by creating tokens without the permission of the original artist. This practice has sparked a new wave of copyright theft that has even affected Banksy’s work.

Also, because NFTs are open source and unique, they may be entitled to their own copyright separate from the copyright of the associated digital image. Separate copyrights can increase the total cost of ownership of an NFT. However, this division of ownership of NFT digital works can further complicate infringement litigation, such as when the rightful owner of the NFT is sued for copyright infringement by the rightful owner of the associated work of art.

Third, NFTs can have serious implications for platform owners in terms of copyright. The owners of the NFT platform may be bound by the United States Digital Millennium Copyright Act (DMCA) or the European Union Copyright Directive (EUCD) or other legislation in regarding the removal of infringing content, response to requests for removal.

These regulations toughen liability for copyright infringement using the Internet, while at the same time protecting providers from liability for user actions.

As a proactive response, some NFT auction sites have already created similar processes to remove unauthorized NFTs.

For example, the NFT marketplace OpenSea states in its terms of service that it will “stop operations in response to formal infringement claims and terminate a user’s access to the services if it is determined that the user has repeatedly infringed copyright.” MakersPlace claims zero tolerance for intellectual property infringement on its platform; its terms of service list an authorized agent for DMCA notices, as well as instructions for filing copyright infringement claims.

Today, we, as specialists both in the field of law and in the field of cryptocurrencies and digital assets, are forced to state that the rather explosive development of NFT technology requires deep and appropriate legal regulation of this area. However, the explicit prohibitive bias of the norms of Federal Law N 259-FZ, coupled with their lack of elaboration, creates additional risks for everyone – and primarily for bona fide participants in the turnover, hindering the development of new business areas. As a result, such regulation reduces the attractiveness of Russian jurisdiction.

Therefore, taking into account the actively growing interest in the crypto world and the lack of effective legal regulation of this area, it is vital in the Russian Federation to adopt norms that specify, on the one hand, and simplify, on the other, all the rules for the circulation of digital assets available in the current legislation, including NFT.

Otherwise, business and technologies built around the blockchain industry will continue to leave our country for other jurisdictions, and Russia will lose not only world markets, but also the chance for technological and digital development in the next half century at least.

This publication has been prepared with the support of lawyers DRC

.