how the Bank was created in VK

Hi all! VTB team is in touch “Messengers and chat bots. Today we will talk about how we worked on one of the largest and most unusual projects in recent times. At the end of 2022, it became clear that VTB’s digital services should be scaled up and moved to new platforms due to the unavailability of the mobile application in the stores. Such a solution was required so that each client could use the services of the bank online; This was especially true for owners of iOS devices. One of the obvious solutions was the release of the online bank into social networks and instant messengers, mobile applications familiar to most people.

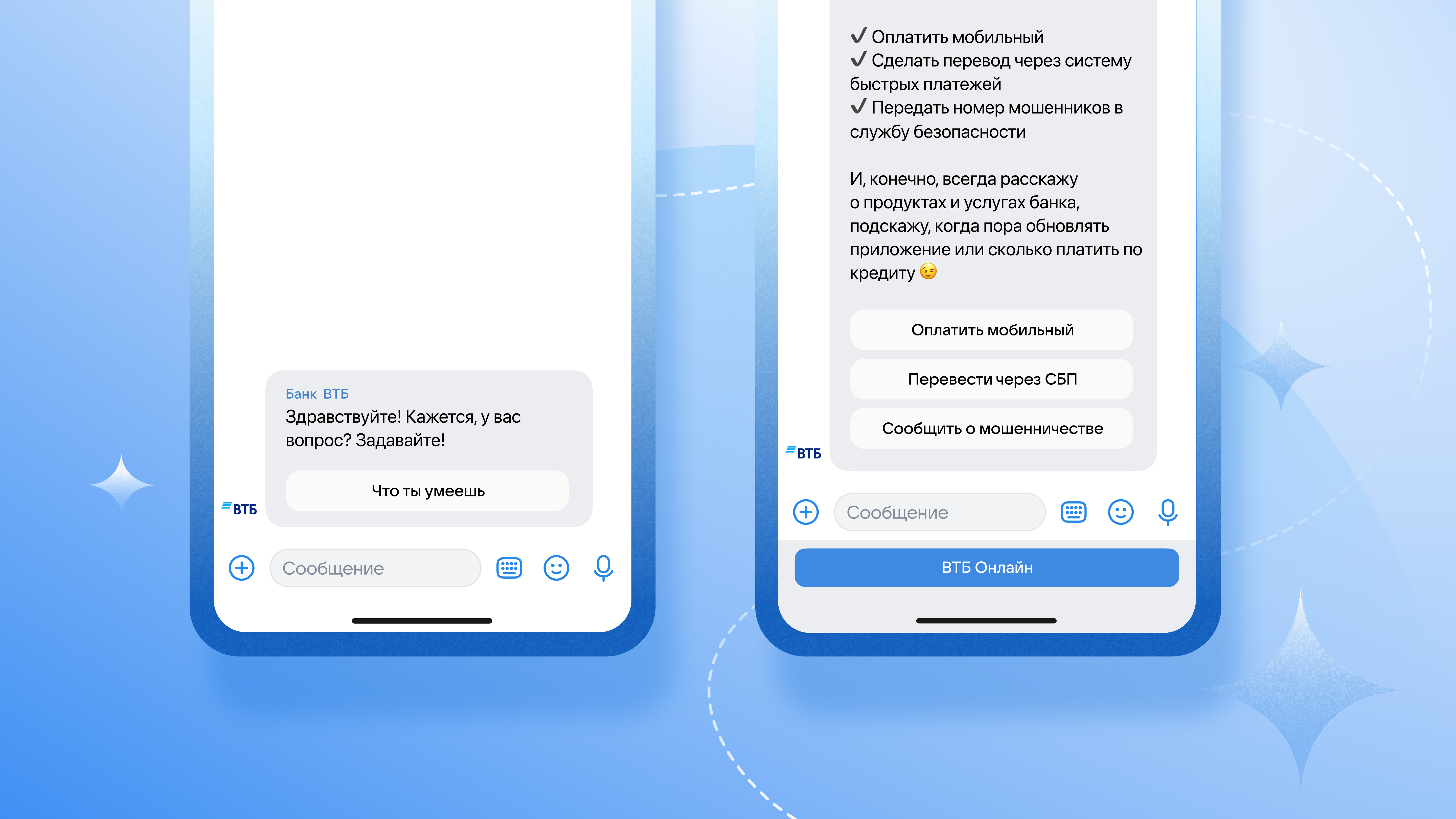

This is how we started integrating VTB Online into Telegram and the Russian social network “In contact with”. And in doing so, we ran into several questions. How to use the messenger interface to access highly sensitive information? How to make authorization as convenient and secure as possible? How to create a clear and convenient menu? We share insights in the article.

Getting Started: Launching the VTB Chatbot on the VKontakte Platform

Chatbot VTB in “In contact with” appeared in March 2023 – the service is similar to what works in other social networks and instant messengers, for example, Telegram and Viber. An important spoiler: you can only communicate with the VTB chatbot from the bank’s official community page on VKontakte by clicking on the messages.

Almost immediately after the appearance of the chat bot, VTB launched the Bank directly on VK, with access to financial transactions. To create a new full-fledged service, it was necessary to solve a number of serious tasks:

Ensure the security of credentials and other confidential information of bank customers.

Adapt the client path for financial management on a site with a very large number of products and services.

Reuse the previously developed solution for Telegram without modifications.

Leave native text scripts for messaging between the client and the chatbot. And for operations on accounts and cards, use new opportunities.

At the very beginning of the work, we identified the key stages of creating a service, studied the quantitative and qualitative studies that we had previously conducted. In particular, it was important to understand how:

create an MVP version with authorization;

ensure a high level of service security;

develop an optimal design concept;

test the finished functionality.

Now what? What is the best way to get started and what options are best to run at the first stage? First, let’s turn to convenience and customer experience.

From a chatbot to a full-fledged online bank: how to think through important little things

The VTB chatbot has one common knowledge base: you can get equivalent information about the bank’s products and services in any channel where the service works. We are talking about a zone without mandatory authorization – the sender of the request remains unknown, so you can consult in such channels only on general issues, without transferring personal data.

Before starting the development of a bank in messengers and social networks, we carefully studied how users communicate with the bank in a chat bot. For example, what requests are received most often, how often the user visits the chatbot. In fact, there were a lot of questions. It turned out that such unauthorized channels as WhatsApp and Telegram are mainly used by existing VTB customers. At the same time, 70% of those who contacted Telegram are with iOS devices.

The main concerns related to the security of using messengers due to the lack of necessary experience among customers, as well as difficulties in authorizing using a login and password. After all, a large number of customers are accustomed to using biometrics when entering VTB Online, they have refused to enter data manually.

Authorization by a set of credentials for VTB Online is the first thing a Bank user encounters on VK. Only this approach meets the requirements of safety and is able to provide comfort.

“Initially, it was planned to make an entrance to the online bank by biometrics, but the platform has a number of technical limitations that make this implementation temporarily impossible. Of course, to minimize risks, we took into account various factors for processing data for authorization: a short “lifetime” of the session, validation of the “lifetime” of the signature, the presence of a user with such a VK ID, and others”, — Vladislav Makarov, CJE of the Messengers and Chatbots team.

How to choose a UX concept: bank or social network?

The bank in VK was created for a young modern audience, and the design of the service should correspond to this. Of course, a banking service on a social network platform requires the creation of a lighter interface compared to the operation of classic digital banking services. Therefore, the Bank’s menu in VK is not overloaded with buttons, while each operation is completely performed on one screen, without transitions and additional clicks. At the same time, the speed of conducting transactions in VTB through the Bank in VK increased on average by 2 times due to the creation of a service code from scratch.

“The novelty of the concept lies in the fact that all options work within one window. We minimize the number of steps and the time spent on the operation in order to get the maximum query execution speed. The user does not need to click the buttons once again – view banners or extra screens. Thus, the process takes just a few seconds. As for the UI part, we decided to make the design concise,” — Daria Berdysheva, designer of the Messengers and Chatbots team

The bank in VK has acquired a concise menu — anyone can quickly understand the principle of operation. And during the operation, transitions from field to field are easy, as well as interesting elements and dynamic animation.

Popular transactions in VTB Online account for up to 80% of all transactions. Earlier research showed that customers are interested in a new experience of using online banking and everyday services – transfers by phone number, cell phone payments, checking the balance of cards and accounts. This means that there is no need to transfer the entire online bank to VKontakte, and the most important options can be offered to VK users of the Bank. Nothing extra.

Let’s give an example with a cell phone payment scenario: the service automatically substitutes the client’s number, but this number can be deleted if desired. Also, for the Bank, VK reused “chips”, which replace the need to open the keyboard and manually enter numbers. This is especially true for transactions such as paying for a cell phone – the collected “chips” are ideal here.

How to ensure security?

Bank in VK transmits confidential data of the social network? No that’s not true.

We were able to use the interfaces of third-party services to go to the authorized zone of the usual VTB Online in the browser. Any actions of the client are performed on the bank’s servers with a high degree of protection, and information containing personal data or bank secrecy always remains under lock and key.

The work of an online bank in the contour of a social network requires the maximum degree of security. Therefore, all the structural units responsible for security were involved in solving the problem. A lot of work was done by specialists in the field of protecting corporate interests, managing regulatory and operational risks, as well as countering fraudulent transactions.

“We were able to save all protected information in the bank’s circuit, it is not available either to the VKontakte platform itself or to any other user. In fact, in our solution, we use a third-party platform as a browser to raise web forms located on the bank’s servers when an authorized client action is required, for example, a transfer or a payment. — Alexander Raikhin, Product Director

Together with the Bank of Russia, we worked out requirements for the security system, from which we did not deviate at all stages of implementation. At the same time, the Bank’s team at VK was responsible for the “service” side of the issue and had to find solutions to take into account all the requirements and maintain the most convenient customer paths.

At the same time, scenarios of fraud through the so-called “social engineering” show that technology alone will not help protect customers from deception. It is necessary to constantly educate people on the safe use of communication with the bank, and we do this, including through our channel. Here, experts clarify how to distinguish an official bank account from a fake one. We remind you that VTB never asks for bank card details, SMS codes, customer information in a chat or during a phone call.

“Almost 100,000 people have already managed to communicate with the VTB chatbot and have shown interest in the new financial service. We continue to work on the development of the Bank in VK, and now we are actively using the best features of the messenger, including for security. Now bank customers don’t have to think about how and where to find and download a banking application, but simply go to their favorite messenger and manage their finances 24/7,” Alexey Sinitsyn, team leader.

We did it. We made a bank in the next chat 🙂