Why is negative money attitudes so hard to actually change?

The topic of money beliefs seems beaten down like a punching bag. But you start digging – and it turns out that the topic is very interesting. How, for example, is the search for oneself and changing professions connected with limiting monetary attitudes? And they can be directly related. Or how a rise in wages can cause fear of death? But maybe. This article is about internal conflicts, innocent parental phrases and the fact that money is never about money.

money and death

I have a remarkable story. In 2007, I worked in a logging company as a deputy chief accountant, and when the position of chief accountant became vacant, I was offered to take it.

I refused

It seemed to me that an incredible responsibility would fall on me, filling out reports and communicating with the tax office. At the same time, there were no objective grounds for my fears – I had already kept balance sheets, filed tax returns and dealt with the tax, so I would not have to learn anything fundamentally new. Finally, after a very long persuasion, I agreed with a creak, and when I received my first salary, which was 2.5 times higher than the previous one, I was covered.

At the same time, I felt incredibly cool – of course! — I had the highest salary in the company, not counting the founders of the business, and very vulnerable. I was embarrassed in front of my colleagues – after all, I did not deserve such money. Also, obsessions began to arise, how I walk (so cool) and get hit by a car. Or dying of cancer. Or a brick falls on your head. For a couple of months I was thrown on an emotional swing from euphoria to horror.

It was then that I first realized how tightly connected money and the fear of death can be, and how strong the resistance can be when entering a new level of income. And most importantly, it may not be realized at all. Let’s understand why this happens.

“Parents are to blame”

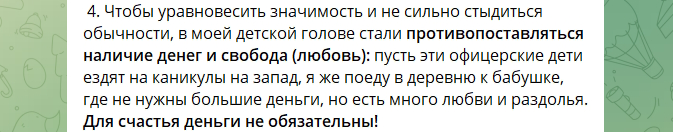

We absorb the attitude towards money literally “with mother’s milk”, because in one way or another we catch how parents relate to money. In some families, monetary attitudes are voiced in the form of ready-made concepts. For example, “there were no rich people in our family”, “money is only evil”, “making money is difficult”. Other families don’t say anything like that, but even the seemingly innocent phrase “we ran out of money” or “we can’t afford it” means that money is a limited resource that cannot be managed.

The matter is aggravated by the fact that relationships with money are emotionally charged. The dad says, “We can’t afford it,” and feels guilt, which the child picks up. Mom says: “Lyudka again bought new boots for herself, and where does she only get money from ?!”, and the child feels condemnation and envy for rich Lyudka.

As a result, the immature children’s brain learns that money is a scarce resource, which is difficult to obtain, and it is dangerous to own it, because you will be envied and not loved. Such a belief is acquired unconsciously and is not so easy to change in the future, because, firstly, it turns out to be tied to vital needs for security and acceptance, and, secondly, it is not realized.

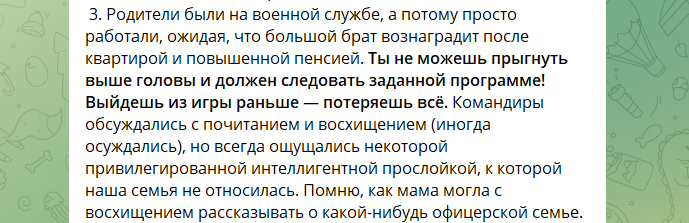

And not only parents

The history of our country is full of examples when the rich were shot, the wealthy were dispossessed, and those who wanted to live well were blamed and shamed. Naturally, the charge of fear of wealth has come down through the generations, and the 90s gave it new grounds.

My childhood just fell on this criminal time, when the windows on the first floors were overgrown with bars, iron doors began to be installed not only in apartments, but also on landings. I regularly heard stories that someone was killed, someone was robbed. There were serials on TV in which bandits extorted money, and then some bandits were killed by other bandits in order to take possession of this money.

The feeling that money is associated with danger was in the air, but I’m not sure what was realized by my children’s brains, but it came back to haunt me later, when the salary increased, and children’s fears unpacked.

Moneyless firmament or how a glass ceiling is formed

I think that many of us are familiar with the situation when, despite all efforts, it is not possible to reach a new level of income or gain a foothold on it. Neither a change of job, nor a profession, nor freelancing, nor your own business helps – everything changes, except for the money in your pocket. Where does this glass ceiling come from?

The reason often lies in the settings, moreover, of two types at once:

-

money beliefs

-

Beliefs about how to achieve goals (including monetary goals)

For example, if you learned as a child that “money is evil,” then in order not to look like a villain, you will unconsciously get rid of excess money and dodge the opportunity to earn it. For example, so that you understand the level of my resistance, I will say that I was persuaded to become the chief accountant for several months – I did not agree and actively helped to look for a new chief accountant, and gave up only after the ideal candidate refused.

However, it is even more interesting when installations related to how we are used to achieving goals put an end to income growth. For example, for a long time I was convinced – “to have a lot of money, you have to work hard.” As a result, ambitious and money projects made me despair. It seemed to me that I would stretch my legs trying to realize these projects.

The mindset that “you have to work hard to make a lot of money” cracked when I first managed to sell accounting services (my first business). We talked for half an hour with the head of the company, then I drew up an agreement and came to the meeting (I walked in front of the office for a long time, trying to pacify the panic). The head casually looked at the amount, said: “I see that the money is normal, it seems that everyone should have enough,” and signed the contract. It seemed to me then that in ten minutes I earned more than in 4 months, and my brain just exploded: “What, it was possible like that ?!”

By the way, the first money independently obtained in freelancing or business often irreversibly change thinking. My wife works as a psychologist, and before that she worked as a marketer in large companies and was convinced that you can only earn money by hiring. When the first client paid her 500 rubles, my wife even took a picture of this money, before she could not believe that someone could appreciate her services and pay for them.

Internal war

Limiting attitudes are unpleasant in and of themselves, but they are flowers compared to the situation when you suddenly find that your attitudes are mutually exclusive. As Woland said to Berlioz: “Convictions limit, and that would be half the trouble. The bad thing is that they sometimes also contradict each other, that’s the trick!

The psyche in this case is in a state of permanent conflict. For example, on the one hand, you are convinced that “only bright and successful people are worthy of respect and can earn a lot”, and on the other hand, that “to attract attention and show up is dangerous.” And the deadly battle begins.

How might this conflict look from the outside? For example, you understand that you want to make yourself known and provide cutting and sewing services. This thought is inspiring, and on this energy you create a website and start running social networks, but the part responsible for security catches on and starts sabotaging activities – it becomes unbearable to write posts and talk about your services too.

However, since the attitudes are not realized, and the conflict remains unconscious, consciousness quickly looks for a rational explanation: “The art of cutting and sewing is not mine, I need to find another business for myself.” You give up sewing and take a great interest in photography, but as soon as it comes to presentation, it’s all over again. As a result, you spend years looking for yourself and trying to reach a new level of income, although the problem is not what you do at all.

Why you can and should deal with your monetary settings

There is a good phrase that “money is never about money.” And indeed it is. Since beliefs about money are laid down in childhood and are assimilated uncritically, things that are in no way connected with each other are stuck together in one heap.

For some, money is tightly glued with self-confidence, for some, “earning well” = “being sexually attractive”, for some, money is a source of threat, for some it is a source of security, for some it is evidence of lack of spirituality , but for someone enlightenment.

From what meanings we load money, they become our angels or demons.

That is why it is so useful to understand what power we give money so that we control them, and not they control us.

A simple example. For a long time, I lived with the conviction that “selling is unworthy.” This belief not only cost me money for many years, but also made my negotiating position on other issues weak, since it also seemed wrong to me to sell my ideas and convince others of something. At the same time, I did not even understand why this was happening (beliefs were unconscious), I simply avoided situations where it was necessary to influence and sell.

My attitudes directly influenced my decisions and my behavior, and there was nothing I could do about them. It turned out “unconscious decision making”, and this, frankly, is a shitty way to build a life and make money

What can be done about it? You can take inventory of installations yourself. Although they are unconscious, but by certain emotional and behavioral signs they can be detected and formulated. You can work with a psychologist. And you can go to a workshop on monetary settings – there are quite a lot of them, and if you are interested in the one that I conduct, then information can be found in the telegram channel.

I believe that in order to change for the better, it is enough to be seriously interested in how we work, and I write a lot about this in my telegram channel, so if an article seemed interesting to you, subscribe.