What fintech patents did Russian companies receive in 2022?

The concept of financial technologies (or simply fintech) includes almost all developments that banks or payment systems can use. However, officially, the concept of fintech implies innovative technologies used by financial organizations, such as big data, blockchain, artificial intelligence, and others.

Development of financial technologies — one of the goals Central Bank of Russia. A detailed plan for their development for 2022-2024 is set out in the relevant project. We offer you to see what Russian companies have patented in 2022.

What is happening with fintech in Russia in general

In 2019 Russia took third in the world in terms of fintech penetration and first in terms of awareness of fintech solutions in payments.

The Central Bank of Russia has developed several roadmaps for the development of financial technologies. The initiative covers the digital ruble, remote identification, a fast payment system, the Marketplace online service, a regulatory sandbox mechanism (monitoring financial services and technologies on the market), SupTech and RegTech (technologies from the field of legal regulation of the financial market). Some areas of development are also reflected in regulationsincluding the decentralization of finance and the introduction of open APIs.

In 2016, at the initiative of the Bank of Russia, the FinTech Association was created, bringing together at least the Central Bank of the Russian Federation, Gazprombank, NSPK (national payment card system), VTB, QIWI, Sberbank, Tinkoff, AK Bars, Rosselkhozbank, Alfa-Bank, Raiffeisenbank, VSK, Mosbirzhu . At the same time, of all organizations, only Sberbank is actively patenting developments.

The Association is working on the goals set by the Central Bank. In 2021, they established the first blockchain operator in Russia, the Distributed Registry System, and launched the Open API portal with all the relevant information.

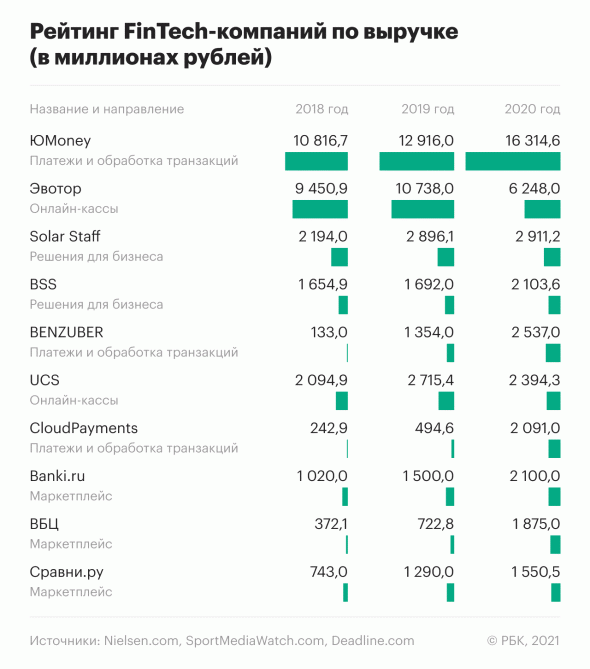

Companies from the above rating of the project “Atlanta-1000» 2021 are also reluctant to register patents. A number of studies note that despite the high level of penetration of fintech technologies in Russia, these are predominantly “light” technologies — payment systems, online services, marketplaces. Decisions on them are predominantly borrowed, rather than invented and registered. The development of more “heavy” technologies – artificial intelligence, big data, blockchain – in the Russian Federation did not have enough resources.

What patents have the companies received?

Sber has distinguished itself by significant patent activity – it owns almost all the developments from the list below. It belongs to Sber Sbertech project, which also makes it so significant in the field of financial technologies. It is Sbertech that provides the bank with most of the technology.

Communication with the bank via video link with information protection on the monitor

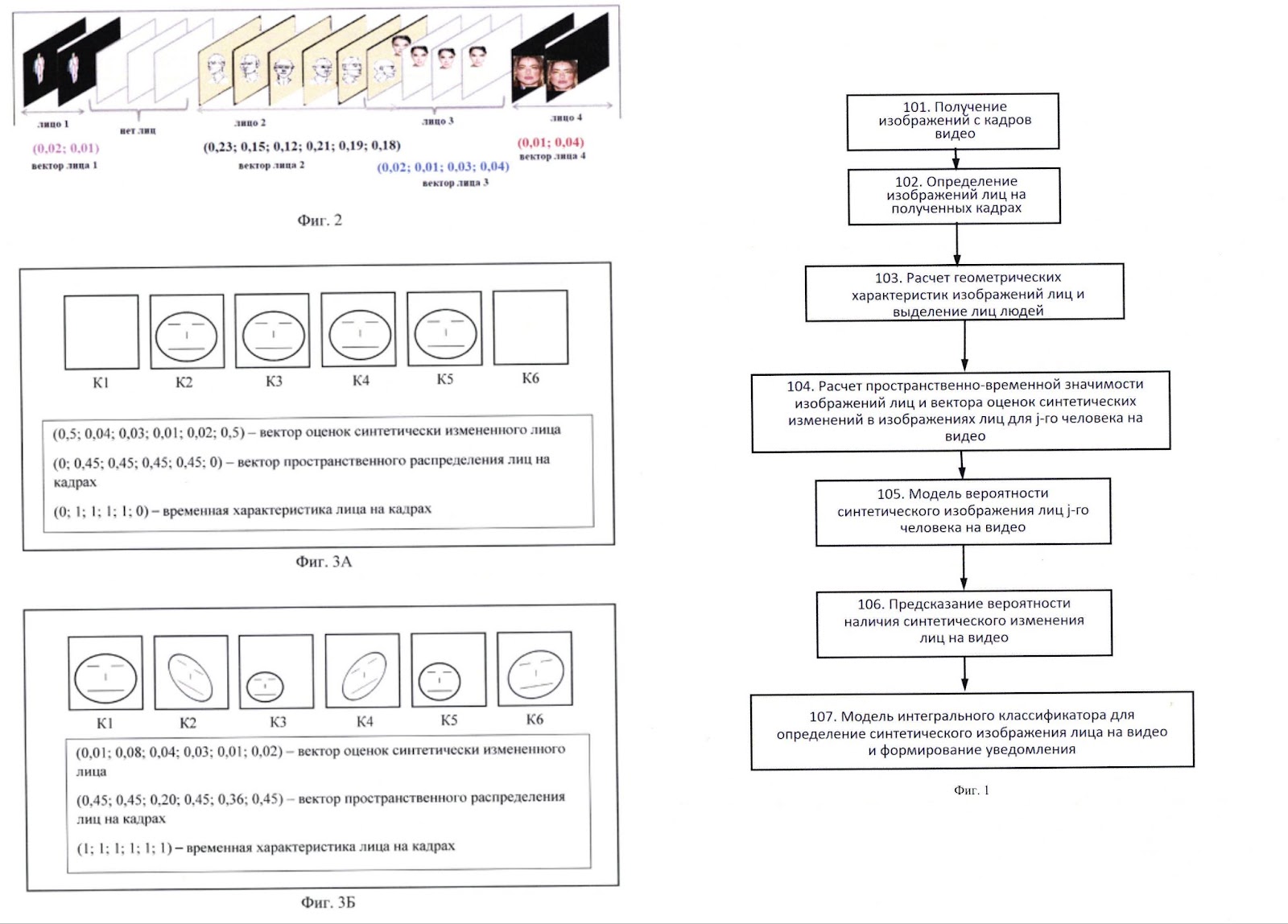

One of the trends noted by Sber in 2022 is customer face recognition systems. One of these is a system for determining whether a person’s face in a video has undergone synthetic changes (patent No.2768797). Machine learning is used to study faces in video, build models, compare and other processes. Over the past year, Sber has been actively developing a system for communicating with customers via video, including looking for ways to issue loans through video consultation. The pilot of such a project was launched at the end of 2022.

At the same time, at least one development aimed at protecting data presented on the screen of monitors has been registered (patent No.2768533). This digital information protection system involves the use of digital labels (DM) – blocks of graphic elements placed in a geometric pattern. That is, a translucent substrate will be displayed on the monitor screen to protect and encode information, automatically adjusting to the amount of encoded data.

Work on security

Not all developments in this area use innovative technologies, but they can still be interesting.

Increased security of cash deposits through ATMs. Sber patented the system (patent No.2767284), which, upon receipt of a request to cancel the accrual of funds, will receive a photo of the one who conducts the operation, compare it with the reference one and decide on the execution of the command. Another patent (No.2767285) is aimed at eliminating failures in cash transfer operations.

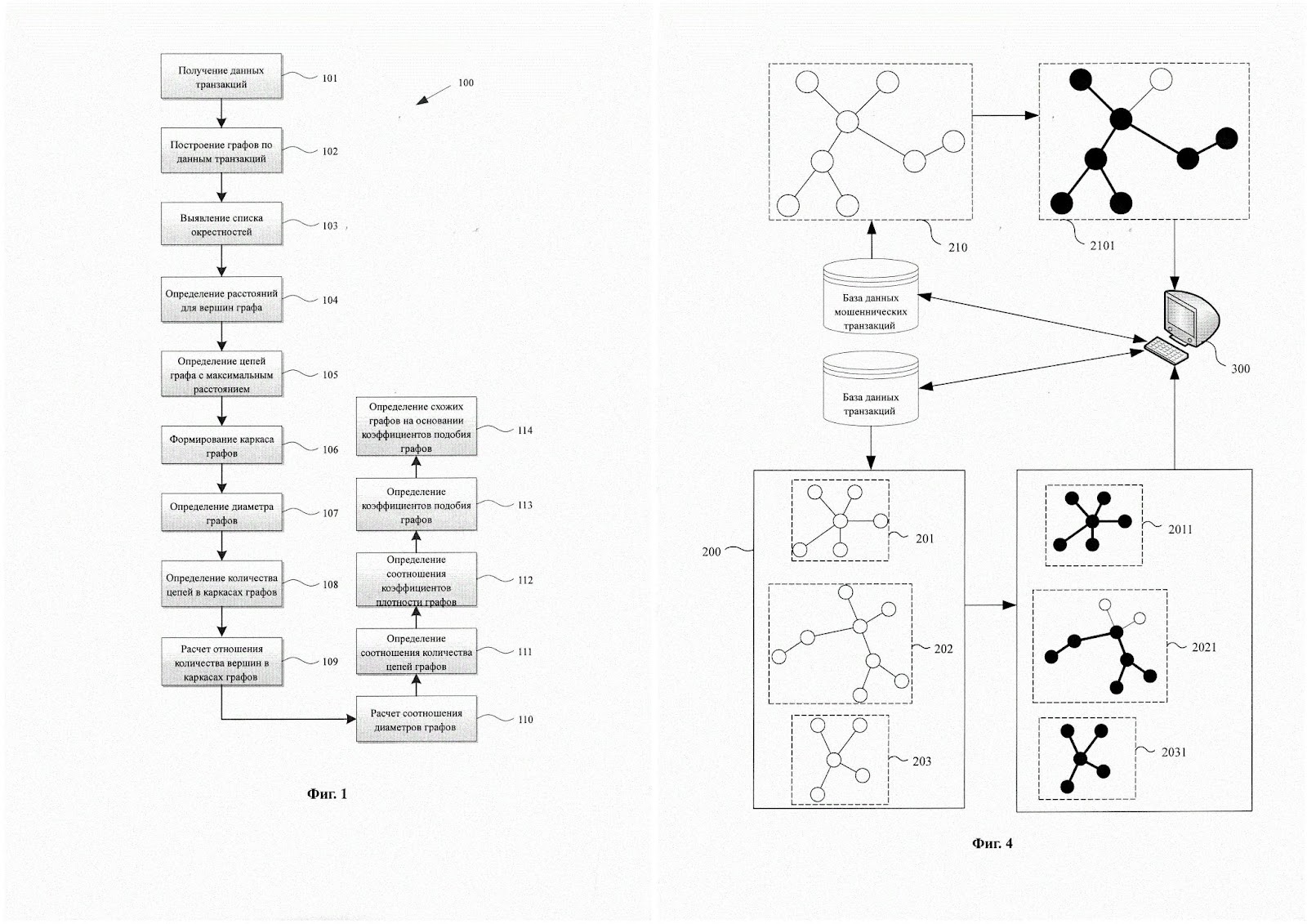

Work is underway to detect and eliminate scammers. Yes, patent no.2769084 describes a way to find similar fraudulent groups from graph models. That is, the system automatically compares the transaction with known fraudulent schemes and makes a decision based on this. Below are some of the circuits presented in this patent.

Work is also underway to improve the security of mobile devices. Patent No.2779521 describes a system for identifying a device when installing an application. The purpose of the patent is also to detect fraudulent transactions.

Created his development in the field of identification and Tinkoff – he owns patent No.2779249. This is a development for determining the ownership of a bank card by a user, using data about his location and geographic coordinates.

Blockchain implementation for transactions

Blockchain is called a special case of distributed registry technologies, which are included in the Central Bank’s list of the most important technologies. Both technologies allow transaction information to be stored in a new, more secure and less manageable way.

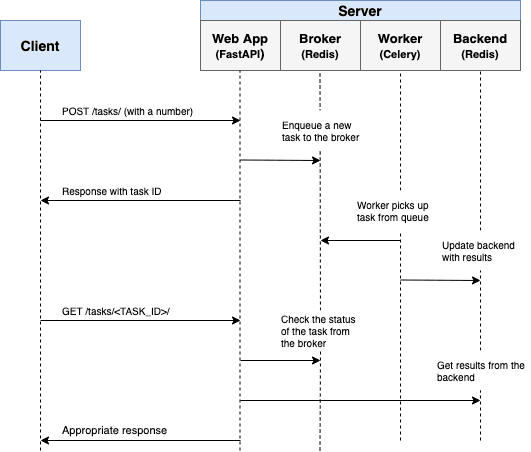

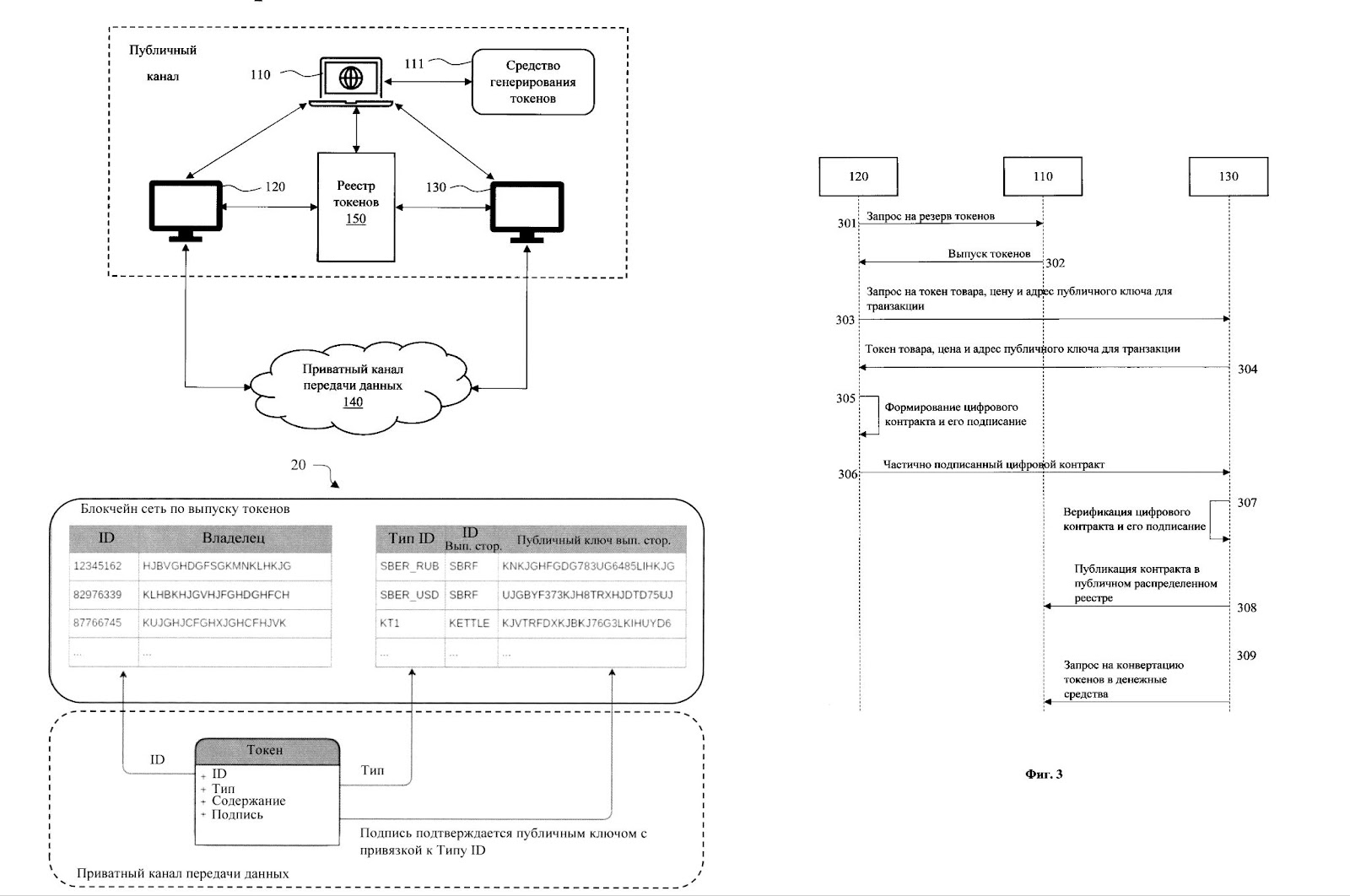

Sber registered a patent for the use of distributed ledger technology in transactions between legal entities (patent No.2768561). During the transaction, digital tokens will be generated corresponding to the obligations of each of the parties to the transaction. Each token contains a unique ID and is associated with the public key of its owner. Some schemes for this patent are presented below.

Results

Despite the fact that the financial technology market in Russia is quite well developed, new developments in this area are patented by only a few market participants. In a 2020 interview with Big Data Technology Director of Beeline and Deputy President-Chairman of the Board of VTB Bank notedthat large corporations are working with many start-ups. The latter at the same time affect a variety of areas: from contactless payments to the use of artificial intelligence. However, as the experience of 2022 has shown, the patenting of fintech developments is now mainly carried out by a company with a developed IT infrastructure and large budgets – Sberbank.

About the service Online Patent

Online Patent is the number 1 digital system in the Rospatent rating. Since 2013, we have been creating unique LegalTech solutions for the protection and management of intellectual property. Register in the Online Patent service and get access to the following services:

Online registration of programs, patents for invention, trademarks, industrial design;

Submission of an application for inclusion in the register of domestic software;

Options for accelerated registration of services;

Free search in databases of patents, programs, trademarks;

Monitoring of new applications by criteria;

Online support of specialists.

For more articles, analytics from experts and useful information about intellectual property in Russia and the world, look at our Telegram channel.

Get a discount of 2000 rubles on your first order. More details in the pinned post.