Microchip shortage – the iceberg may be bigger than it seems

Anton Startsev, senior analyst at MKB Investments

Recently, in the news stream, there are more and more reports about the shortage of microchips in the world market. The attention of the general public is mainly focused on the automotive sector, which creates the illusion of a local nature of the problem, however, the acceleration of demand growth with limited opportunities to increase the supply of semiconductor microcomponents in the market, in our opinion, makes one think about the possibility of a significant transformation of the market as a whole. Here we are trying to give the big picture from an investor’s point of view without implying any investment advice.

Demand: acceleration after lockdown

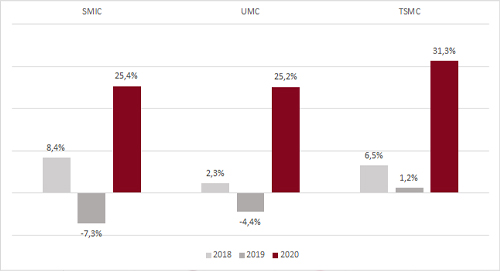

The past year has required semiconductor industry players to effectively adapt to a rapidly changing demand structure. The first wave of “lockdowns” was a factor in reducing demand from certain industries (for example, the automotive industry), but at the same time – a rapid growth in the segment of computers and mobile devices due to the departure of a significant part of the global economy from offline to online. Already in the third quarter, a recovery in demand from the offline segment began, which, together with the continued online activity, provided revenue growth of the largest contract manufacturers (foundry) at double-digit rates for the year.

The rate of change in revenue in $ year-on-year for three manufacturers

Source: Bloomberg, MKB Investments estimates

We would venture to suggest that the reports of interruptions in the supply of microchips for the automotive industry, received during the first months of this year, are just a small stroke in the overall picture of the accelerating growth in global demand for the electronic component base (EEE) from both traditional industries experiencing a wave of digital transformation and branches of the “new economy”, which are in the early phase of their development, but are more demanding in terms of parameters and volumes of hardware. Examples of the latter include the industries of the Internet of Things (IoT), artificial intelligence (AI), electric vehicles (EV), cloud computing (Cloud Computing, CC), which, according to various forecasts, may show double-digit average annual growth rates in the coming years. … The sector of mobile devices, although it has already firmly entered the daily life of most of the world’s population, can also claim an explosive growth in demand for new generation microcircuits, taking into account the prospects for the proliferation of 5G networks, and in the not so distant future – 6G.

Some of the fastest growing semiconductor component consumer industries include:

Expected compound annual growth rates (CAGR) by sector:

|

Sector |

CAGR forecast for the coming years |

A source |

|

Internet of Things (IoT) |

16% – 40% |

|

|

Artificial Intelligence (AI) |

17% |

|

|

Electric vehicles (EV) |

5% – 37%; |

|

|

Cloud Computing (CC) |

13% – 14% |

|

|

Mobile devices |

8% |

Internet of Things (IoT). The 2020 IEEE (Institute of Electrical and Electronics Engineers, standards developer and key industry think tank) roadmap provides McKinsey Global Institute estimates of the size of the Internet of Things (IoT) market, with global volume ranging from $ 4 trillion to $ 11 trillion by 2025. GSMA Intelligence gives a more conservative estimate of the IoT market size at $ 1.1 trillion. (the same 2025), expecting an increase in the number of connected IoT devices from 9.1 billion in 2018 to 25.2 billion in 2025 (CAGR within 17%). A Cisco report cited by the IEEE predicts that the number of IoT devices will grow to 500 billion by 2030 (CAGR of almost 40%).

Artificial intelligence (AI). IDC predicts that the overall artificial intelligence (AI) market (including software, hardware and related services) will grow by an average of 17.1% per year through 2024. Currently, the lion’s share of the AI market is in software (80%, according to IDC), but the growth rate in the edge and cloud computing segment may be higher than in the market as a whole – IDC says that this segment is forecast to grow by more than 35 % for the next year.

Electric vehicles (EV)… Electric cars still account for a modest 3.3% of the global passenger car and SUV market (hereinafter – estimates based on data from IHS Markit, cited by Forbes). However, the EV segment is expected to be the fastest growing in its industry, with IHS Markit forecasting a CAGR of over 37% for the EV market through 2025, versus 5.4% for the global car market as a whole. A large number of semiconductor elements are needed to manufacture any modern automobile, but electric vehicles are generally more “microcircuit-intensive” products than traditional vehicles with carbon-fueled engines.

Cloud Computing (CC). Verified Market Research expects the cloud computing market to grow at an average rate of almost 14% per year until 2027. The development of high-speed communication standards (5G, 6G) is likely to drive more active use of cloud technologies.

Mobile devices. The Cisco Annual Internet Report 2020 predicted that the number of connected mobile devices will grow from 8.8 billion at the end of 2018 to 13.1 billion in 2023 – an average annual growth rate of 8.3%. Note that this is higher than the expected growth rate of the number of subscribers, i.e. Cisco’s forecast assumes an increase in the average number of mobile devices per user (by about a third in five years).

Supply: cost pressure

According to our estimates, the semiconductor industry is unlikely to be able to quickly solve the problem of scaling up the business in response to accelerated growth in demand. We see several factors putting upward pressure on the costs of microchip suppliers and slowing down the increase in production volumes:

– high utilization of production capacities limits the potential for a rapid increase in volumes, specialized publications report the complete exhaustion of free capacities in certain segments;

– Measures to combat the COVID-19 pandemic increase the costs associated with ensuring a safe working environment for employees, and in some cases, complicate logistics;

– a part of the production capacities previously laid down in Asia, as a result, did not enter the world market due to restrictions on the supply of equipment from the United States, the PRC’s response includes an increase in the reserves necessary for production and support of manufacturers focused on the domestic market. The “trade wars” started by the Trump administration, apparently, will not be over under the new presidential administration: J. Biden recently signed a decree on the verification of microchip supply chains, implying, among other things, the intention to weaken the dependence of the American semiconductor industry on supplies from China;

– the increase in the complexity of technological processes leads to a diminishing return on investment in research and development. So, in the recent review MIT says that the cost of building one microchip production line (fab) has increased by 13% per year, and this increase in the “barrier to entry” leads to a narrower list of companies willing to invest in the development and production of chips of new generations.

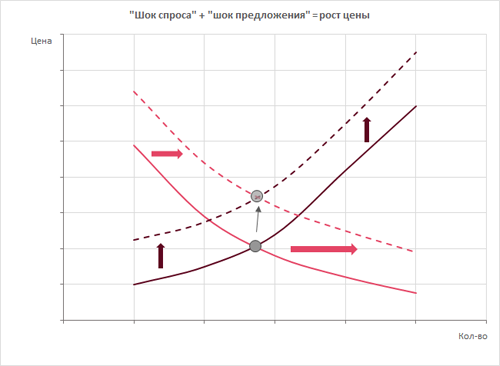

“Demand Shock” with Inertial Supply – A Lesson from Microeconomics 101

In the language of economists, the global semiconductor market is in a phase of a shift in the demand curve to the right, while the supply curve is either stationary or (more likely) shifting upward (“cost inflation”). The picture, familiar to everyone who lived to see the first session at an economic university, obviously hints at the prospects for price growth (however, unfortunately, it does not answer the question of at what physical market volumes a new equilibrium will be found).

The stock market does not stand aside

The situation in the semiconductor industry has not gone unnoticed by investors. The S&P 500 Semiconductors & Semiconductor Equipment sectoral stock index, which reflects the dynamics of the value of the largest players in the sector, listed on the US stock exchanges, increased by 42% over the past year, against a 16% increase in the S&P 500 index, which corresponds to the “broad market”. MKB Investments’ clients could earn on the advanced dynamics of the semiconductor and equipment sector by investing in units of the Technological Perspective fund: the value of the unit (in rubles) increased by 46.4% over the past year.

We believe that the transformation of the microchip market structure is an evolving story that promises investors not only periods of excessive price fluctuations (increased volatility), but also long-term growth potential.