How to save finances and even make money in the face of falling markets: structural products

Picture: Unsplash

The Russian stock market has experienced severe turbulence over the past week. Shares of many companies, as well as RTS and MICEX indices are falling. In this situation, investors are looking for tools that will limit possible losses or even make money.

One such tool is structural products. Today we’ll talk about what it is and how it works.

Introduction: what are structural products

A structural product is a financial instrument that allows an investor to earn money by not buying assets directly, but by participating in an increase or decrease in the price of them. This approach allows you to limit risks and make a profit not only during periods of growth, but also during market falls.

The structural product consists of several financial assets and instruments and allows you to receive income on a monthly or quarterly basis, which significantly exceeds the income from bank deposits.

Structural products have various parameters, here are the most important ones:

- number of assets as part of the product;

- minimum investment amount – a certain starting amount may be enough for one strategy and not enough for another;

- product term – what time the strategy is designed for;

- coupon type – guaranteed or fixed (conditional) coupon or a combination thereof;

- type of barrier – American, European;

- barrier level – usually from 50% to 75%.

How it works

Usually in structural product 3-4 assets are included. The underlying asset in the product is one of these three or four securities, that is, a stock showing the most negative dynamics from the initial price. Product term is also always fixed. At the time of purchase of the product, the initial price of securities (the Avtokoll level), which are included in the product, and the barrier price are fixed.

Then, in the case of a guaranteed coupon, the investor receives income in% per annum of the invested capital, regardless of the value of the securities included in the product, during its life. A note may be revoked early if the price of the underlying asset is higher than the level of the autocall – in this case, the investor will receive his money back plus a coupon in% per annum of the invested money. If at the maturity date of the product the price value falls below this level, the investor will lose part of the capital – the loss will equal the value of the fall of the underlying asset from the initial price.

In the case of a conditional coupon, the calculations are slightly different. If at the time of observation, the price of the underlying asset is higher than the initial price, then the note will be withdrawn ahead of schedule – the investor will receive back the invested capital in full, plus a coupon in% per annum of the invested funds.

Terms of coupon payment during the product validity period: if at the time of observation, the price of the underlying asset is lower than the initial price and higher than the barrier price, then the investor receives a coupon in% per annum of the invested funds, and the note continues.

If at the time of observation, the price of the underlying asset is lower than the barrier price, then the investor does not receive a coupon, and the coupon is “remembered” and is payable in one of the following monitoring periods if the price of the underlying asset returns to a level above the barrier price.

When the note is redeemed, if the price of the underlying asset is higher than the barrier price, the investor receives the back capital invested in full, plus a coupon as a percentage per annum of the investment. If the value of the price of the underlying asset is below the barrier price, then the loss of the investor will be equal to the value of the fall of the underlying asset from the initial price.

How it works in practice

ITI Capital analysts have developed a product that consists of shares of four foreign companies:

- DEVON ENERGY (DVN)

- Halliburton Co. (HAL)

- Marathon Petroleum Corp. (MPC)

- SCHLUMBERGER | SLB

The parameters of a structural product with a conditional coupon look like this:

| Income per annum: | + 15.0% RUB + 14.0% USD + 12.0% EUR |

| Payout of income | Every 3 months |

| Product term | 3 years |

| Autocall | During the first half of the year – 100% Further, the amount of capital at prepayment is reduced by 3% every three months (97%, 94%, 91% …) |

| Underlying assets | DVN, HAL, MPC, SLB |

| starting price | one hundred% |

| Observation period | Every 3 months |

| Capital barrier | 55% of the starting price |

| Coupon barrier | 55% of the starting price |

Early redemption of notes

If, at the time of observation, the price of the underlying asset is higher than the initial price level (Avtokoll). Then the investor will receive early back the money invested, as well as income as a percentage per annum of the amount of invested funds.

The condition for the payment of income during the product period

In each of three years, if at the time of observation, the price of the underlying asset is lower than the initial price and above the coupon barrier, then the investor receives income as a percentage per annum of the invested funds, the bond continues to operate. If at the time of observation, the price of the underlying asset is lower than the “coupon barrier”, the investor does not receive income, while the income is “remembered” and is payable in one of the following monitoring periods, if the price of the underlying asset returns above the “coupon barrier”.

Note repayment conditions

If the value of the price of the underlying asset is higher than the barrier price, then the investor receives the return on capital in full, plus income as a percentage per annum of the size of the investment. If the value of the price of the underlying asset is lower than the barrier price, then the investor will receive back invested capital equal to 100% minus the value of the fall of the underlying asset from the initial price.

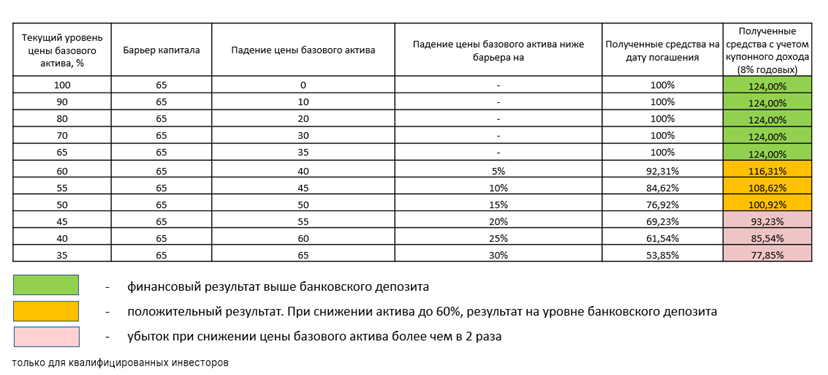

An example of the behavior of a structural product in a falling market

Let us also consider an example of the behavior of a structural product with capital protection in a falling market. The table below shows that if the price of the underlying asset drops by 2 times, the investor will save his money due to the coupon income received.

At the same time, if the price of the underlying asset is above the barrier price, the investor will receive high foreign exchange returns.

Where and how to buy a structural product

To work with structural products, you need a brokerage account – open it can online. Also, to work with structural products based on foreign securities, you must obtain Qualified Investor Status. Then, in your account, you can arrange a structural product. The contract will fix all the important parameters – the underlying asset, product validity period, etc. After this, the investor will only have to wait for the fulfillment of the specified conditions!

Read reviews, market analytics and investment ideas in Telegram channel ITI Capital