How much money do you need to travel without a return ticket? Frankly about finances in the life of a nomad

Hi all!

Today I am in Singapore and it is very expensive for me here, but I am sure that I will be able to meet my budgets and not have to live in poverty.

I’ll tell you how much I spend, how much travel planning mistakes cost, what I can save on and how I optimize spending.

Let’s go through the most interesting categories, talk about taxes and pensions, touch on currency conversions and shopping.

Housing

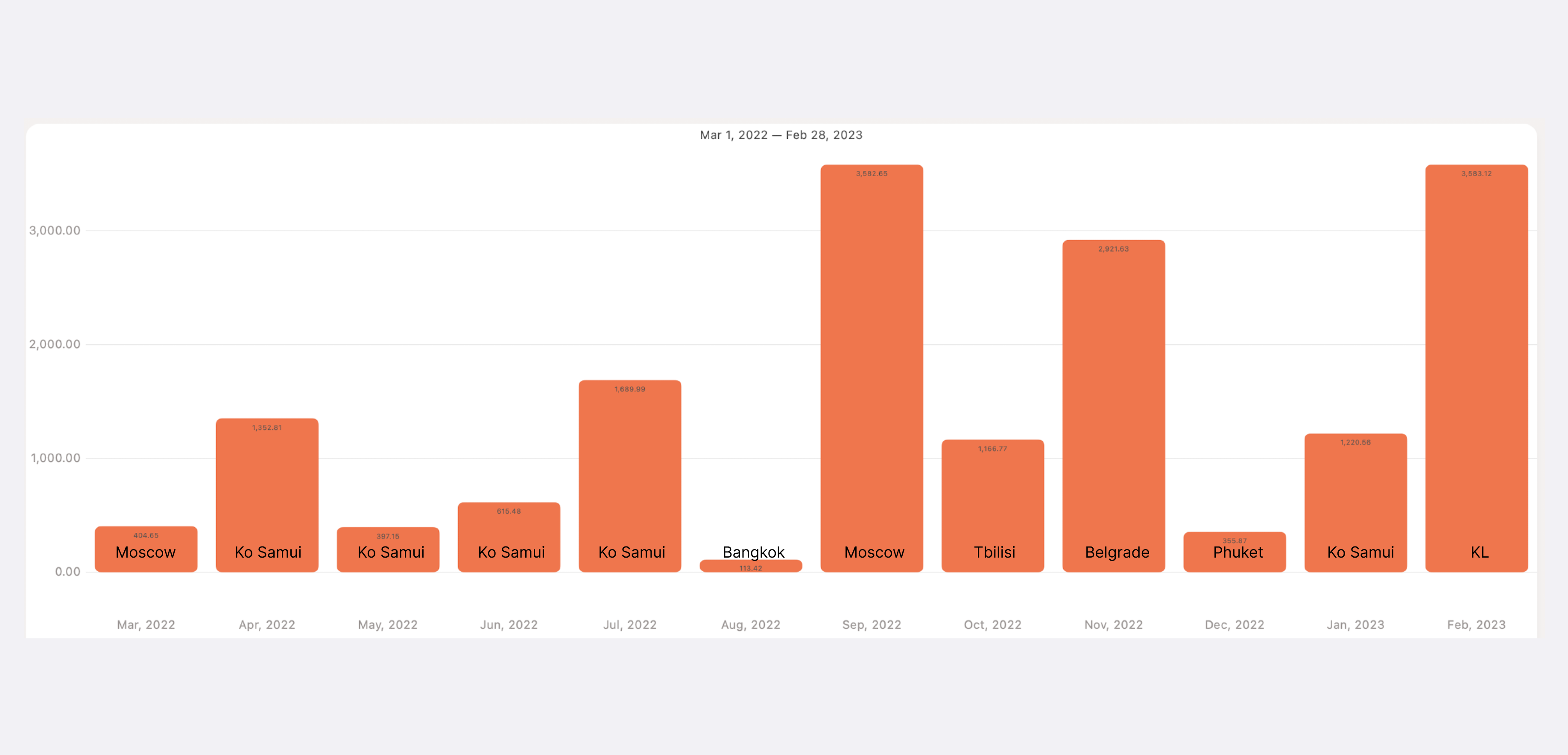

I usually select housing in such a way as to maintain approximately the same comfort everywhere, but this costs very differently in different cities. And it doesn’t always work out.

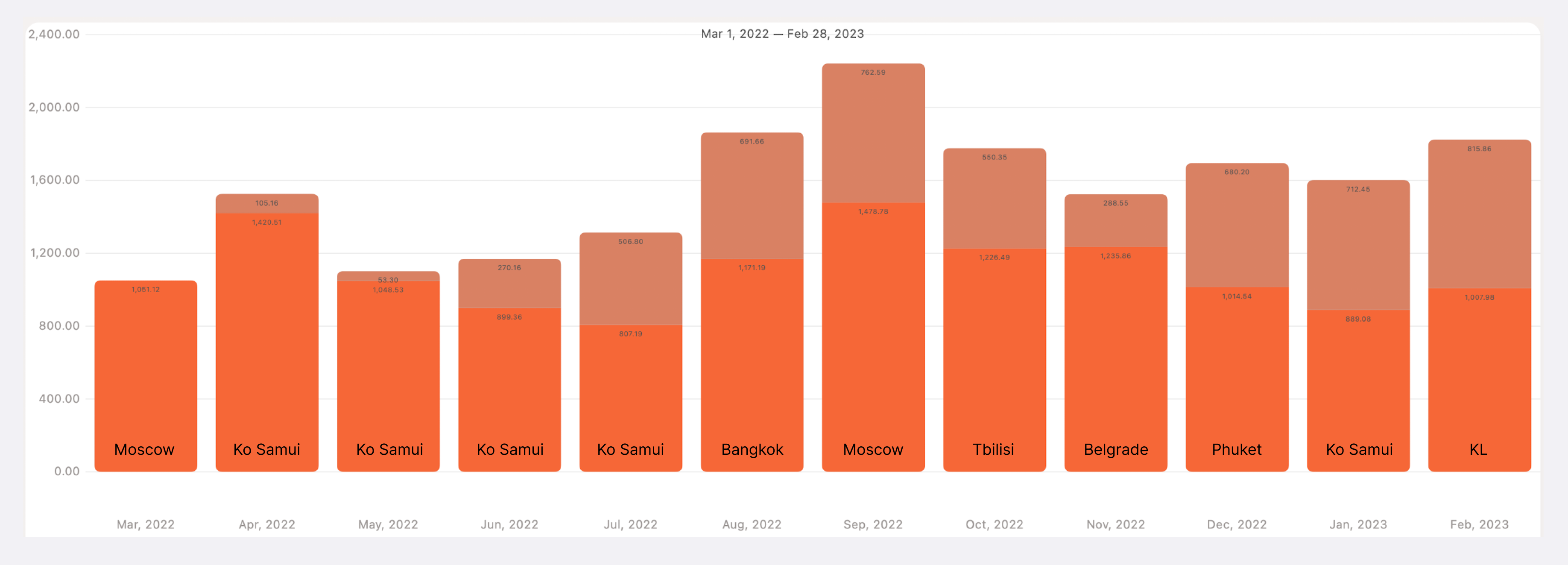

My monthly budget $1500but I don’t discard the “remains”, but transfer it to the next month.

For example, it was very cheap on Koh Samui at the beginning of 2022, and I had accumulated balances in the budget. It cushioned the middle of the year pretty well, where I had to spend over budget in Moscow. And now, due to the very expensive Singapore, I’m out of line again, but next month in Vietnam will smooth it out.

Payment dates do not always coincide with calendar months, as well as flight dates, so it seems that Bangkok is very cheap, and KL is very expensive. In fact, things went like this:

It was critically cheap on Koh Samui during covid restrictions

And it became several times more expensive after they were removed.

In Moscow, it is very bad with short-term housing. No Airbnb. Price / quality at a very low level

In Singapore, everything is bad with housing in general, it is inadequately expensive

In Bangkok and KL you can live in luxury apartments for a nice price

Tbilisi and Belgrade have risen in price due to Russian and Ukrainian refugees, but still more or less keep within price / quality

With a monthly housing budget, I can’t guess, so I smooth the months against each other, alternating between cheap and expensive cities.

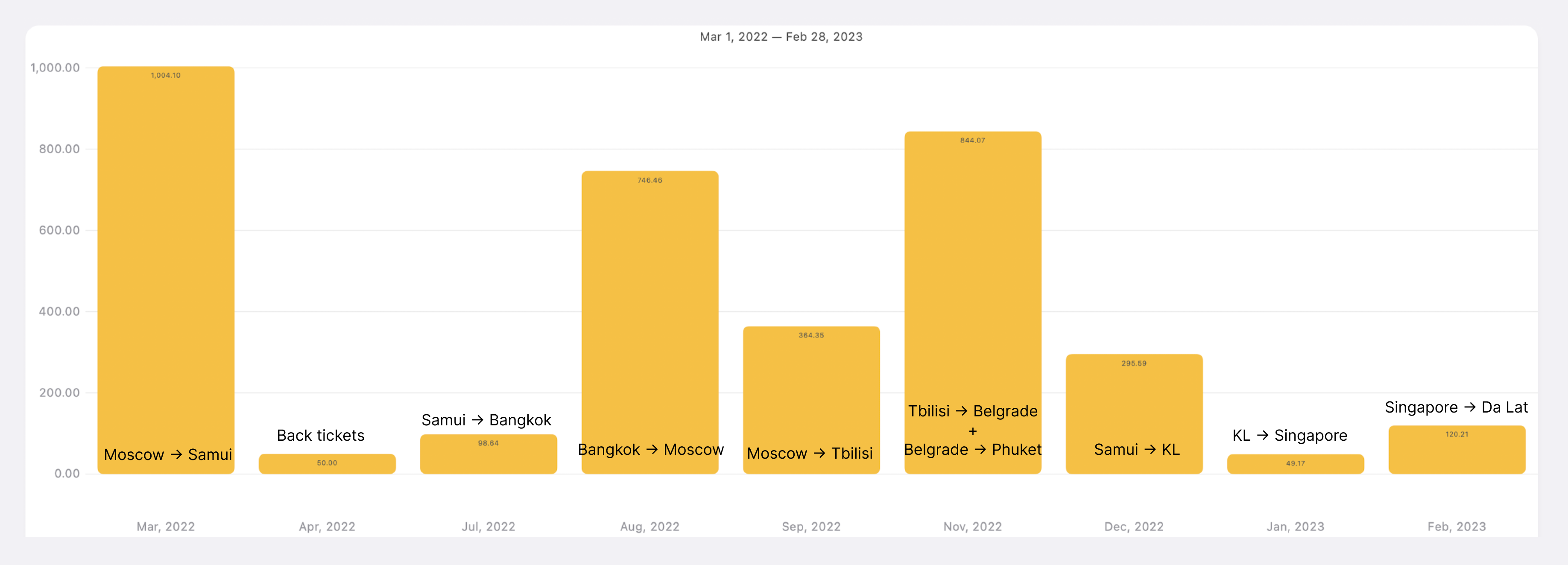

flights

I don’t have a specific budget for air travel, because this category seemed too difficult to control for me. Roughly speaking, if you want to fly from Moscow to Tai, then at least you crack, it will not be free. Here are my spending on airfare for one:

However, it is this category that lends itself to extreme optimization with long-term planning!

Everything is banal simple:

If you fly less often, you need to buy tickets less often 😁

If you fly short distances – tickets are dramatically cheaper

It dawned on me when I flew from Europe to Thailand THREE TIMES in a year and a half 🤦🏻♂️

Now I deliberately visit neighboring countries in succession so that flights are cheap and take less time. We do not fly through the entire globe!

By the way, I didn’t succeed in taming the bonus programs of airlines, they don’t cooperate well, and as a result, they accumulate a little bit of bonuses everywhere, but I can’t spend them in one place.

Food

I don’t save on food, I love to eat delicious food, and I also don’t have a desire to cook, so I usually don’t eat at home: in cafes, markets and restaurants.

Our (two) monthly food budget is limited. $2000and this is how food spending over the past 12 months looks like:

You can see how the amounts even within the same city can vary greatly, the average has grown over the year, but still does not reach the budget limit.

In Singapore, I am first crazy about food pricesbut quickly rebuilt and started eating at cheap hawker centers.

My conclusion from this: if there is an adequately planned budget, and the habit of sticking to it, in any country you can find comfortable options for eating without lunch.

nologa

Disclaimer

I’m not a tax lawyer and generally don’t understand the topic of taxes. I just consulted with the tax authorities and googled a bit.

Reader, remember: each country has its own chaotic tax rules, there are penalties for tax evasion, and sometimes even remote work on a tourist visa can be illegal.

I’ll tell you right now – taxes are one of the two top nomad savings items!

Under certain conditions, for example, the absence of tax residence in any country, no one will demand taxes from you at all. True, there are many exceptions, for example, in Georgia, tax residence is not at all expected, but from the first day of your work they want to receive taxes.

I have optimized taxes to 1% with the help of the Georgian IP. I don’t owe taxes to Georgia, since I don’t live and don’t work there, so I could just as well not pay them to anyone, but I pay in case of questions from banks and brokers. And this has come in handy for me. applying for Taiwan Gold Card.

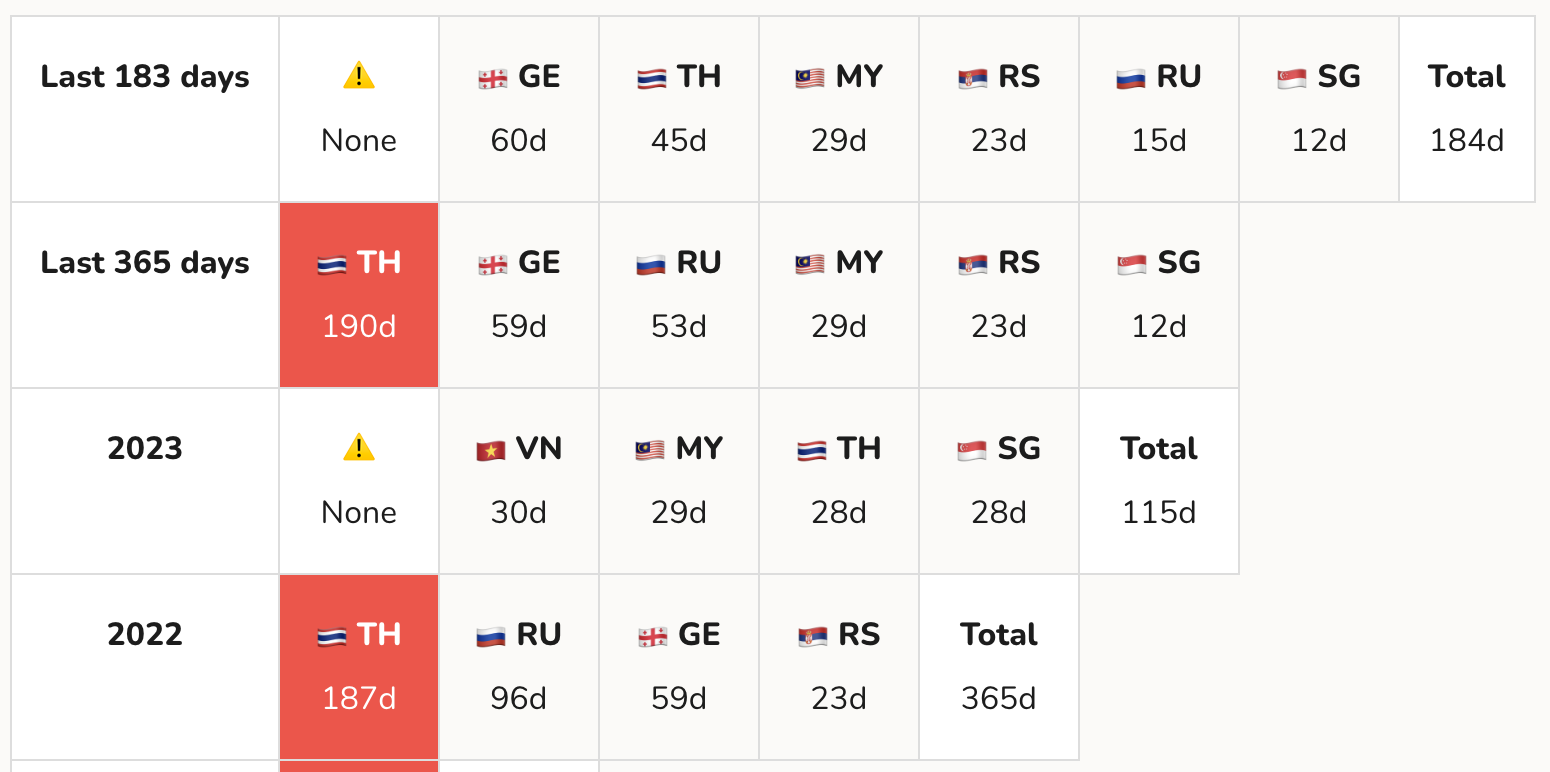

I recommend studying the tax rules of specific countries, looking for real cases, forums, such as reddit, are well suited for this. Keep track of your tax residency “days”. Many countries use the standard scheme 183 days a year == resident. But not all.

By the way, even taxes are optimized if you work for a Russian employer under the Labor Code, first from 13% to 30%, when the residence is lost 😁. But they write that you can turn it into 0%.

Pension

So, if you work like me – under a contract, then ..

Guys, be careful, no one here pays pensions!

It may seem that this is extremely bad, but I see positive aspects in this:

The state will not freeze or cancel my pension

I choose my retirement age

I determine the amount of the pension myself

In short, we need to save money for a happy old age ourselves.

I will not give specific advice, as I am not strong in investments, but I will tell how I postpone:

I count the time of retirement using calculators FIRE.

I use Interactive Brokers, I buy Vanguard funds like VTI, VOO. I throw money away from the RFP and don’t go there anymore.

I put a small percentage in BTC, because I believe in its future.

I also invest a very small percentage in startups, through the Republic platform, so far out of interest, the money has just gone there but has not yet returned.

Additional expenses

Insurance I am currently using Safetywing travel insurance. coming out $42 per month. I plan to upgrade to a more complete insurance, from them, it will come out about $ 200-300 per month.

Visas – everything depends very much, so far it turns out a little for me: about $0 to $50 per month. Application for a long-term Taiwan Gold Card came out at almost $200.

Currency conversions and transfer fees – the whole world costs 1-2% more for you, you just need to accept it. I optimized the number of currency conversions from 3x to one, and thus it became cheaper to live. But some commissions remained, for example, for transfers to a brokerage account.

Simcards – the price is unpredictable and completely depends on the country. But often it turns out more expensive than at home. For example, in Singapore, a 100GB SIM card cost me $22.

Museums, theaters, parks – are more expensive for foreigners. This also had to be accepted.

Bonus

The second item of savings abroad is shopping. Of course, it depends a lot on you, but for example, I simply don’t have free space in my suitcase, so buying new things happens only to replace the old ones. Minimalism permeates the life of the nomad.

But now there is shopping in cities on Nomadlist 🛍️

Subscribe to my TG channel – there I talk about my journey in real time and share interesting findings and thoughts.