How is the insurance industry in China being automated by AI?

Insurance companies are actively implementing Large Language Models (LLMs) to improve efficiency and personalization. This includes both general tasks (data analysis, automation) and specialized ones – interactive agent training, improving customer service. The model is implemented through two strategies: private deployment, which increases security, and API integrations for flexibility. However, the development comes with high costs and data protection challenges, requiring standards for the sustainable application of AI in insurance. In this article, I propose to consider how Chinese insurance companies solve their internal needs and what specific results they achieve by providing an outside perspective.

The future will be a world where everything is connected to AI – this was predicted by Kevin Kelly, founder and editor-in-chief of the magazine Wiredin his article “The World in 5000 Days.”

It's been almost two years since ChatGPT kicked off the large scale model (LLM) craze. The capabilities of such models continue to grow, and the development of applications based on them has entered a new stage.

“2023 was the year of rapid development of basic large models, and 2024 was the year of their active implementation in applications”“,” notes Liu Yan, deputy general manager of the artificial intelligence department of Taikang Technology Operations Technology Center.

Today, the development of large models has slowed in terms of investment, and the focus is shifting from training models to applying them, he said. Instead of the compute-intensive resources and algorithms needed to train models, efforts are now focused on product applications. Large-scale model technologies are evolving from text-based language models to visual and multimodal integration, and the creation of intelligent agents.

This means that in 2024, the use of large models will accelerate the adoption of products and solutions in specific scenarios. In practice, large models are showing real results in increasing efficiency, improving customer experience and facilitating digital transformation of companies in industries such as manufacturing, smart energy, oil and gas, mining, healthcare, education and transport.

In the financial industry, large models are considered a kind of “new infrastructure.” Taibao Technology CEO Wei Jiaohua notes: “With the rapid development of large models, they have become an important tool for the financial industry. For example, BloombergGPT from Bloomberg, BondGPT developed by LTX based on GPT-4, and the open FinGPT model are all created specifically for the needs of the financial sector.”

In the insurance segment, large models are also widely used. As noted by Yang Fan, Chairman of the Board of Xinmei Mutual Life Insurance, in an interview with Caijing: “Insurance is a very complex product, but it is its virtual nature that makes it the most suitable area for AI application among all financial sectors.”

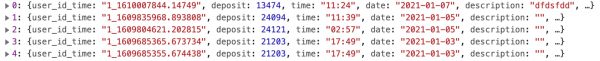

According to Zhiyan Consulting, the market size of large models in China's insurance industry was 3.84 trillion yuan in 2018, and reached 5.1 trillion yuan by 2023, an increase of 5.72% per year. Currently, several large insurance companies in China, such as Ping An, Taibao, PICC, Sunshine Insurance and Xinmei Mutual Life Insurance, are actively introducing large models.

From an insurance application perspective, large-scale models can be used across all phases of business processes—they can be integrated into underwriting, claims handling, inspection, and other phases. Their main applications include marketing, office process automation, underwriting, customer service and coding support.

According to the study Caijing,China's insurance industry is currently in the early stages of introducing large-scale models into specific scenarios. From internal tasks, such as knowledge assistance and intelligent office work, to external ones, including B2B and B2C applications, this path is considered common for the application of large models in insurance.

From an implementation perspective, initial results are already visible in the use of large models to improve efficiency within companies, to support agents and partners on the B2B side. This helps insurance companies improve efficiency and accuracy in stages such as product development, marketing, customer service and claims processing, overall improving efficiency across the value chain. On the B2C side, large models are still mainly used at the level of basic customer interaction. To use them directly, it is still necessary to consider and solve security issues, as well as control and comply with the requirements for the generated content. At the technological level, the insurance industry is actively working to create industry-specific large models.

Sun Zhenxing, chief technology officer of Ant Group's insurance division, speaks to the magazine Caijing noted that the insurance industry is characterized by complex data processes that include large amounts of multimodal and unstructured data (such as insurance conditions, various claims documents, insurance policies, visual and text materials), as well as a variety of customer service and interaction scenarios. them. Large model technologies can significantly improve automation and service quality to meet the needs of the insurance industry. However, as a professional and highly regulated financial industry, insurance requires large models not only to have general knowledge and simple logic, but also deep industry knowledge, complex decision-making, and the ability for large and small models to work together to complete tasks. Therefore, only large models specially developed for the insurance industry will be able to solve professional problems in insurance customer service.

Adopting large models within insurance organizations is seen as a necessary path, and companies cannot afford to fall behind. At two levels—improving overall productivity and creating innovative solutions for specific insurance scenarios—large models are gradually pushing the boundaries, penetrating inward and spreading outward. Initial implementation results:

Reducing costs and increasing efficiency is just the first step

Major models in the insurance industry are not only a process of technological improvement, but also a change in the business model.

Until 2023, in the so-called pre-major model era, the role of AI was largely focused on reducing costs and increasing efficiency, according to some experienced insurance professionals. However, with the advent of large models in 2023 that are capable of compressing vast amounts of knowledge and demonstrating human-like interaction in natural language, overcoming challenges of perception, logic and expression, the transformation of the insurance industry in the future will be fundamental.

At two levels—improving overall productivity and creating innovative solutions for specific insurance scenarios—large models are gradually pushing the boundaries, penetrating inward and spreading outward. Liu Yan notes that with compliance as a priority, one should first focus on developing internal scenarios and then implementing them into external client scenarios, gaining experience in using large models and taking into account controlling the risks associated with their implementation.

NVIDIA CEO Huang Renxiong said on October 12: “I hope that one day NVIDIA will become a company with 50 thousand employees and 100 million AI assistants that will support all parts of the company.”. In Huang's vision, NVIDIA will massively introduce AI assistants (agents) into each of its divisions in the future to improve productivity. These AI agents will break down tasks into smaller steps, each performing a separate task, to achieve larger goals.

Similar forecasts are taking place in the insurance industry. According to Wei Jiaohua, large models are currently being piloted in China Taibao for office process automation, testing and research, health insurance claims, auto insurance and auditing. The projects are currently in the testing stage, but with further improvements to the core platform and expansion of application scenarios, it is planned that by 2025, Taibao's digital assistants will be able to support 10 thousand employees, increasing productivity by more than 30%.

“It is because of large-scale model breakthroughs in ways of thinking, levels of autonomy, and lower marginal cost of simulation that they are able to simulate human abilities. Regardless of the specific task, as long as the model has the necessary skills for the role, she can independently and flexibly use the tools to solve the current task,” Wei Jiaohua explained China Taibao’s digital workforce logic, in which a person’s capabilities are modeled by a large model to improve the efficiency of business processes .

Cognitive and application technologies are being aggressively deployed to support office processes, from desk assistants to computer-aided programming and knowledge retrieval, according to Sunshine Insurance. For example, Sunshine Office GPT has been used more than 770,000 times, reaching 84% of head office employees, and employees report significant improvements in the efficiency of day-to-day paperwork. The technology team uses large models to support programming, creating the Ivy GPT software assistant, which has already been deployed across nine teams of 497 people. This allows you to save more than 50% of your work time on checking security and code compliance and more than 60% on generating standard code for creating new systems.

For innovative applications in scenarios unique to insurance, large-scale models offer new hope by turning “rough predictions” into “precise predictions.”

According to Zhao Xueyao, chief risk officer and chairman of the Digital Management Committee of Xiangmei Life, now large models in Xiangmei Life are being applied gradually and are in the testing and implementation stage. At the stage of sales support and two-level risk control, the models are already being used with positive effect, which helps the company further reduce costs and increase efficiency. For example, a personal consultation assistant for mid-tier health insurance customers was recently launched and has an answer accuracy rate of 98.33%. Another example is Ant Insurance's Ma Xiaocai insurance intelligent assistant, based on the large Fenghuang model. It can answer a variety of customer questions, including complex underwriting and claims inquiries, with an answer accuracy rate of over 95%.

At every stage of the insurance process, large models are challenging traditional risk management practices. By processing vast amounts of data such as insurance claims histories, customer personal data, medical records and vehicle usage histories, large-scale models enable insurance companies to more accurately assess risk and support decision-making.

During the pricing phase of insurance products, large models are able to analyze large volumes of customer data and claims history, helping insurance companies accurately assess individual risk levels and offer personalized rates. However, according to Liu Yan, at this stage, analyzing big data with large models remains a technical task and is not the main application scenario. A breakthrough in this direction requires further development of agent environment technologies, where multiple agents can plan and coordinate actions to analyze and use big data.

Ma Rongqiang, vice chairman of the IT committee of Ping An Health Insurance, noted that in underwriting, large models can automatically analyze policyholders' health data and history, quickly making underwriting decisions. This significantly reduces the amount of manual verification work while increasing accuracy and efficiency.

“Traditionally, the underwriting process relied on manual review and expert judgment. Large models are capable of analyzing a large number of cases and data to make decisions. In the future, the need for so many agents and underwriting specialists may decrease, although large models will also create new jobs, says the president of a mid-sized insurance company.

According to a Sunshine Insurance spokesperson, the introduction of large models into the claims process has been revolutionized. By integrating and analyzing customer submissions, medical records, and historical claims data, large models can quickly identify potential risks and anomalies in claims claims. This not only helps insurance companies detect and prevent potential fraud in a timely manner, but also improves the accuracy and efficiency of claims decisions. In addition, large models can perform automatic application processing, including document verification, payment amount calculation and report generation, which significantly reduces payment times and increases customer satisfaction.

According to Sun Zhenxing, based on the example of the insurance claims settlement process, where fast processing is of paramount importance, new technological paradigms with AI models can achieve 99% accuracy in extracting data from documents and more than 98% accuracy in making payment decisions, which creates the effect of “instant” payments for clients. This means that previously, after submitting an application, customers had to wait 2-3 days to receive results. Now, 82% of outpatient insurance cases and 51% of inpatient insurance are processed in real time – users receive results in literally a minute or even a few seconds. This became possible thanks to the collaboration of multimodal and specialized OCR models.

A representative of one mid-sized life insurance company noted that in addition to improving efficiency in day-to-day operations and customer service, large models open up opportunities for personalized pricing and actuarial calculations, which allows for the creation of products tailored to the needs of individual customers. Thus, gone are the days when one product was offered to everyone. Models can now meet the requirements for customized products, but this is limited by regulation.

According to Liu Minghua, global partner and associate director at McKinsey, an expert in digital transformation in the financial and insurance sectors, AI agents built on large models can independently interact with each other and model the next step, creating a digital community for insurance company clients. .

Sun Zhenxing added that the technology of large models is developing rapidly. In addition to improving the scalability of parameters and data in accordance with the Scaling Law, there are trends towards multi-modality and enhanced learning, which allows models to process images, videos and other types of data, as well as perform more complex reasoning and decision making. Large models will continue to drive innovation in improving service quality and efficiency in the insurance industry.

Boxed solution or API?

According to Liu Yan's analysis, the development of innovation in the insurance industry through large-scale model technologies can be divided into two levels: the first level is productivity improvement applicable to the entire industry, and the second level is innovation in specialized scenarios of the insurance industry. Industry-wide productivity gains include large models for office tasks and personal assistants such as meeting summarization, document creation, data analysis and other scenarios aimed at supporting information in daily work. Applications of large models in industry-specific scenarios include interactive agent training, where large models are used to improve the communication skills of agents in sales and recruiting, in conjunction with a corporate training system. The complexity of the insurance industry and regulatory compliance requirements present both significant opportunities and significant challenges when using large models.

Large insurance companies such as China Life Insurance, Ping An Insurance, China Pacific Insurance and Sunshine Insurance have already begun to develop industry-wide large models and are in the implementation phase, covering both levels of business processes. Details of the deployment strategy can be found in the table.

As investments in large models increase, due to the significant financial and resource costs of development, leading insurance companies are mainly creating in-house teams to develop industry large models with external support. For example, China Life Insurance has established an internal team to develop artificial intelligence algorithms, promoting cooperation with external and internal partners to build an ecosystem based on a universal large-scale insurance industry model, with internal development as the core and external models as supporting models.

On May 22 this year, Xi Mei Life Insurance introduced the major insurance model's vertical application, Chat-Trust3.0. During the development process, the company used a strategy focused on low cost, small data volumes, and rapid iteration. Based on a universal large-scale model, the company strengthened the management and processing of unstructured data, used search technologies, model refinements, as well as plug-in and agent functionality, which allowed for deep development for the insurance industry.

There are two main ways for companies to deploy large models: the first is local deployment, which guarantees data security, but usually costs several million yuan and is suitable for highly data-sensitive industries such as finance, telecommunications and energy. The second way is to use the APIs of large models from suppliers. This option is cheaper because you pay by the number of tokens (the smallest units of data that the model can operate on, such as a word or symbol). This payment model is more flexible and convenient for various scenarios.

Large insurance companies initially used local deployment, but over time, with evolving scenarios, technology upgrades, and cost, the combined model of local deployment and API calling became popular. Medium and small companies mostly use API calls only.

Initially, the cost of deploying large models could reach several million yuan in equipment and services. However, now, with increasing competition and falling prices, these costs are gradually decreasing.

Regarding the cost and benefits of deploying large models in insurance companies, Mar Rongqian noted in an interview Caijingthat when estimating costs, one must take into account the power of computing resources for training and prediction for models of different scales. At the same time, companies must select the optimal vertical areas to apply large models depending on their business scenarios, calculating the cost-benefit ratio. In the areas of core and industry models, companies can benefit from collaboration by focusing on their areas of expertise. It is also important to create supporting technologies, such as the integration of small and large models, knowledge discovery and quality control technologies.

The head of the Jianyan project from Guomin Pension noted that building your own AI models requires significant financial investments, including the purchase of expensive equipment, the allocation of powerful computing resources and the involvement of a team of professional engineers to ensure the effective operation of the model. High initial investments and further operating costs associated with regular updates significantly increase the financial burden of the company.

At the current stage, many companies prefer the strategy of calling APIs from public cloud models with the connection of local knowledge bases. This strategy offers a cost-effective and flexible path, as the largest API providers invest significant resources in developing and updating models, allowing companies to focus on customizing applications for their specific business scenarios.

Paying for API calls based on the number of requests or volume of data allows you to effectively control costs, especially for companies with intermittent usage of the model. This makes such solutions attractive to startups and small businesses, helping them respond faster to market changes and optimize costs.

To implement large models, insurance companies often begin by analyzing the performance of existing models, identifying needs in each line of business, and assessing their suitability. In contrast to the general approach, insurance companies prefer to first test solutions on limited scenarios in order to gradually scale successful results to wider areas.

Tong Guohong, head of Xi Mei's data center, said that to protect sensitive data, companies first create a matrix of customers' personal data, checking that the data meets privacy standards. All data fed into large models is anonymized, allowing models to evaluate data without focusing on specific individuals.

At a forum on October 20, held as part of the annual Financial Street Forum conference, a member of the National Committee of the People's Republic of China, former vice chairman of the China Insurance Regulatory Commission, Zhou Yanli, called for attention to be paid to the protection of personal data, security issues and AI transparency. Zhou proposed developing standards to ensure the safety of artificial intelligence in the insurance industry.

Dear readers, what do you think is happening in the Russian insurance market?

If you liked my in-depth analysis of the topic: “Insurance Automation in China,” then I invite you to your telegram channel “hunt for technologies”where I write about technologies that are gaining recognition from millions of people. I call my channel a space for strategists and innovators, for those who change the rules of the game and are ready to take risks for the sake of the future, destroying old stereotypes. I'll be waiting for you there!