Accounting for workwear and special equipment in 1C: ERP: how to bypass the limitations of typical functionality

A segment of special attention, especially in large production and industrial organizations, is the accounting of overalls and special equipment with the need to promptly obtain information about their availability and condition, not only in total, but also in quantitative terms.

Taking into account the number of departments and their employees, the production or purchase of overalls is a significant expense item. Accordingly, incorrect accounting has a negative impact on the financial condition of the company.

There are a number of limitations in the typical ERP functionality:

-

There are no tools for inventorying goods and materials in operation, which is a mandatory procedure for large companies.

In the system, in principle, it is not possible to generate documents for the inventory of goods and materials in operation. Because of this, the accountant has to form statements in xls, which increases the likelihood of errors, and also increases the time for preparing the necessary information.

-

There is no single report that would accumulate all the summary data on the accounting of workwear.

Quantitative and summarized data are scattered across several reports. For example, in order to obtain information on the quantity and cost of inventory in operation, you need to generate an OSV (balance sheet) for the account and a standard report “Inventory in operation”, and then compare the report data into a single one. With large amounts of data, such a process naturally complicates the work of users and affects the increase in the number of errors.

In addition, the standard report “Inventories in operation” does not reflect those goods and materials for which the service life has ended, but the inventory itself has not yet been written off, which in turn affects the completeness of the accounting data.

-

The movement of overalls on the accounts of the MC and 10.11 within one month is not reflected if it was put into operation in the same month.

Accounting has its own specifics. Imagine that overalls were put into operation in April. The employee used it for several days and transferred it to another. Or another common situation – a marriage was found in the clothes and it had to be written off. And all this happened within one month.

The limitation of the typical functionality of 1C: ERP is that in the accounts of MC and 10.11 the movement of overalls will not be displayed in the same month in which the transfer took place and the write-off or transfer was made. Users will not be able to receive full information on the operation of the garment in April, in which it was transmitted, the data will be displayed only in May. This format contradicts the completeness of the data display.

-

Calculation of the residual value of goods and materials, the cost of which was repaid upon transfer to operation.

In addition to the missing information for correct accounting, many companies are faced with the need to determine the residual value that arises when the inventory is written off from operation during sale or for other reasons.

Now, in the standard 1C: ERP system, all overalls and special equipment (according to FSBU 5), which are transferred to operation, are written off to expenses immediately, regardless of the service life. The problem is that with a full write-off, when the real service life of overalls is not taken into account (such documents are not included in the system for 2021), it is impossible to automatically calculate the residual value, which is important for the formation of a refund for overalls and the financial result during implementation.

Can automation of processes in 1C solve pressing accounting problems?

In our work, we are faced with completely different industries, the scale of organizations, the attitude of employees to the introduction of new mechanisms and rules. But 90% of companies are similar in two respects: the accounting department needs maximum convenience and time savings when dealing with tasks, and the management needs a complete and transparent financial picture of production processes and control of the state of assets.

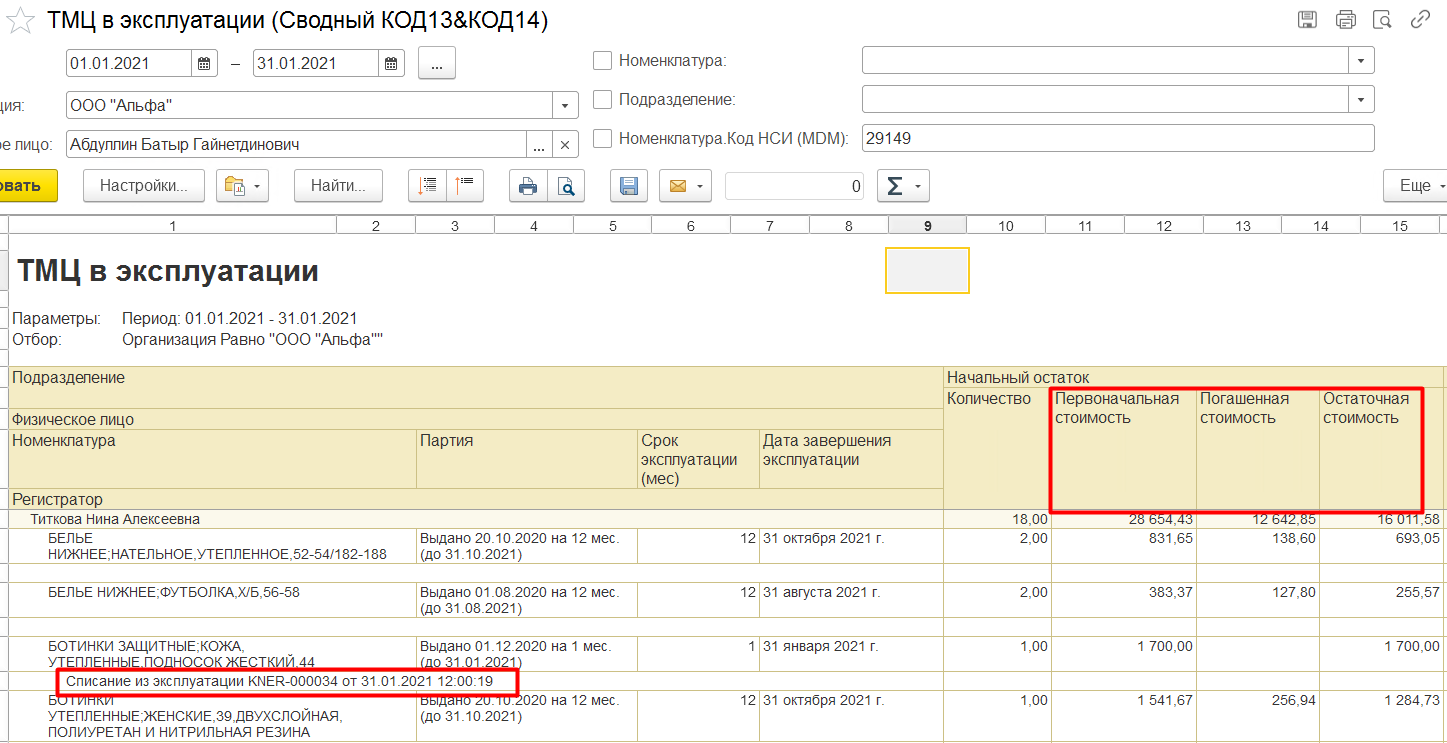

Considering these goals in the context of accounting for overalls in 1C: ERP, to achieve them, it is necessary to automate the accounting of goods and materials. To address the issue of efficiency, completeness and reliability of data on inventory in operation, a report “Inventory in operation” was developed on the basis of a standard 1C: ERP report.

This report allows you to:

-

see sum and quantitative indicators in one report, in the context of all the necessary analytics;

-

work without restrictions on the reflection of goods and materials, the service life of which has ended. The report reflects all inventory items listed in the account, but using the settings, the user can set the selection himself, show him such inventory items or not;

-

see the total figures for the movements and write-offs of goods and materials in the period in which they are reflected in the documents, regardless of the date of their transfer to operation;

-

work with full detail to the primary document, which allows you to open documents directly from the report and make adjustments to it if necessary.

An important point: the report is connected to 1C as an external tool and does not destroy the current processes of the system in which the company operates.

Dealing with inventory

A little higher, we said that 1C: ERP, in principle, does not have inventory documents. But this process cannot be ignored. A good alternative to manual labor would be to refine the 1C system itself, taking into account the nuances of the company itself, since everything is individual here.

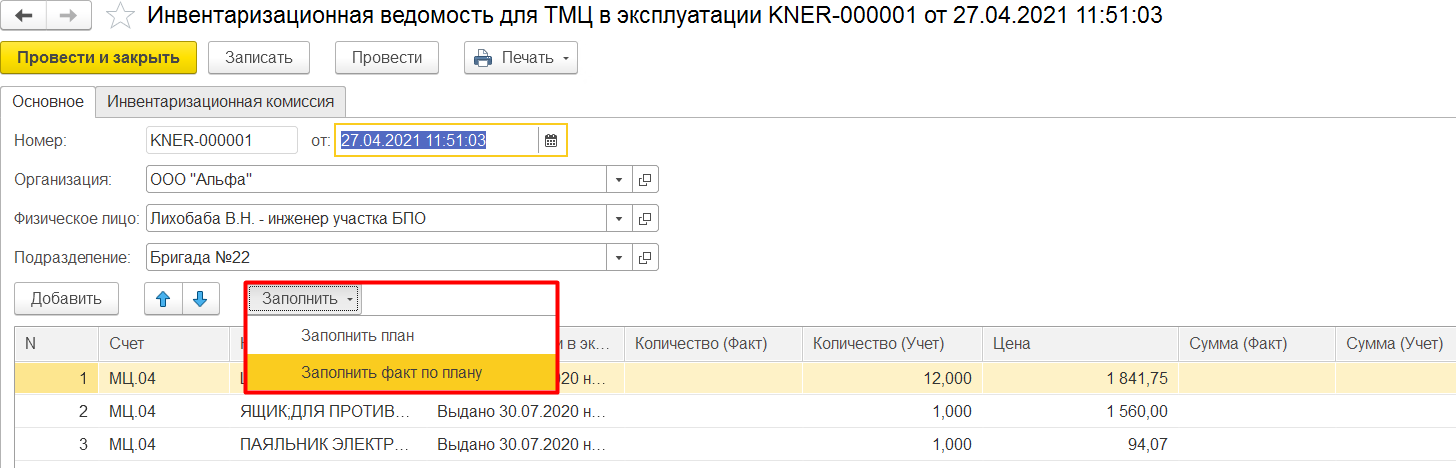

In our practice, as part of the accounting automation process, the system was refined, where we created documents that reflect the inventory, which facilitated data entry and eliminated errors that appear during manual intervention.

The document “Inventory list for goods and materials in operation” is filled in automatically according to the data of the off-balance account of the MC in the amount and quantity, taking into account the data of the operational contour, which allows you to receive up-to-date data after the transfer and write-off documents, regardless of the formation of transactions in the BU. At the same time, the document has the ability to form printing forms INV-3 and INVE-19.

Automatic filling of requisites in documents for accounting of goods and materials in operation

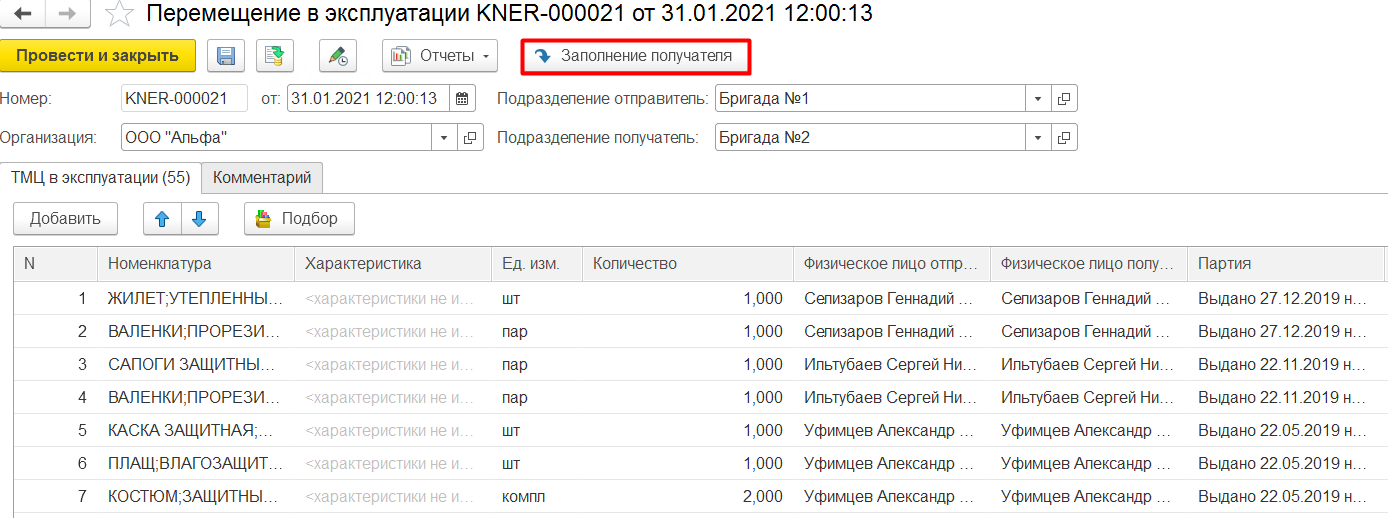

As part of the development of the report, mechanisms were improved to automate:

-

filling in the cost of goods and materials when returning from operation, if at the time of return the service life has not expired or, in principle, there is a residual value on account 10.11;

-

filling in the requisites “Individual recipient” when moving.

Of course, alternative automation solutions can be considered. For example, if a company will generate turnover and then upload the completed excel file to its system. But given the amount of work, we can say with confidence that this method will affect the growth of the number of errors.

In this case, the automation of inventory accounting will become an effective method that will save the company from mistakes that affect the financial condition of the organization, and will also help to promptly make informed management decisions based on correct and up-to-date information on the accounting of workwear and special equipment.

If you have any questions – leave a request, we will consult in detail on the functionality!